After months of refusing to identify their backers, the film production company Red Granite Pictures has now named its main sponsor during an interview with the New York Times.

He is the Abu Dhabi based Chief Executive of Aabar Investments, Mr Mohamed Ahmed Badawy Al-Husseiny.

Aabar is a fund known to have strong investment ties with Malaysia’s 1MDB and also the Malaysian business tycoon Jho Low, whom it backed during a bid for the Claridige’s hotel group in London

Yet, Red Granite, which is owned by Najib Razak’s step-son, Riza Aziz, had earlier threatened to sue Sarawak Report for querying if the hundreds of millions channelled into the company’s various film projects could indeed be linked to Riza’s Malaysian connections and his close party friend, Jho Low.

In a legal letter to Sarawak Report in January Red Granite had stated that Red Granite had no finances “emanating from the country of Malaysia or Mr Low”:

“In fact, the budget of the Picture [Wolf of Wall Street] was financed through traditional sources of motion picture financing, including funds provided by three major financial institutions, tax credits, and foreign presales” [legal letter from Red Granite 2/1/14]

Nevertheless, this new statement by Red Granite reveals very close business ties indeed with Malaysia, thanks to Aabar investments and it refers to Mr Mohamed Ahmed Badawy Al-Husseiny as the only major backer of the company.

In their interview with the New York Times reporter Michael Cieply, Riza Aziz and his partner Joey McFarland stated that Mr Al-Husseiny was investing in Red Granite in a private capacity and not through the Aabar fund, of which he is the Chief Executive.

The duo further explained to the intrigued American news outfit that their previous silence and earlier confusion over Red Granite’s funding (e.g. the contradictory reference to three major financial institutions) was owing to Mr Al-Husseiny’s personal reluctance to be solicited by any other Hollywood producers!

“They were finally free to speak, they said, because Red Granite’s principal film investor, the Abu Dhabi-based businessman Mohamed Ahmed Badawy Al-Husseiny, had agreed to be publicly identified after insisting for years on silence about his involvement. Mr. Al-Husseiny, who is the chief executive of Abu Dhabi’s government-owned Aabar Investments, previously said that he did not want to be solicited by other producers” [New York Times]

Why Red Granite?

These explanations provide as many questions as answers, due to Riza Aziz’s Malaysian connections and his status as a politically exposed person.

After all, why has Mr Al-Husseiny shown so willing to invest in this rookie in the film business, while refusing to get involved with more established Hollywood companies?

Aziz explains that he met Mr Husseiny while working at HSBC during a two year period in London prior to 2008.

At that stage he had not yet chucked in his banking job for Hollywood. Yet this chief executive appears to have been willing to risk hundreds of millions of his own personal money in launching Riza’s brand new company, Red Granite Pictures.

It is therefore clearly relevant that in his public role as Chief Executive of the Abu Dhabi state-owned company Aabar, Mr Al-Husseiny has been involved in billion ringgit deals with 1MDB, which is controlled by Riza’s Dad.

Sarawak Report has also separately established that Aabar has also been in business with Jho Low in a major London hotel bid that was also backed by the same sovereign wealth fund, 1MDB. 1MDB is supposed to be targeted at investing in development back in Malaysia.

Aabar and 1MDB

The 1MDB deals involving Aabar, which is a subsidiary of the Abu Dhabi state-owned investment arm International Petrolium Investment Company (IPIC), have raised considerable questions in Malaysia, not least following the publication of 1MDB’s long delayed financial report for 2013, which was finally released in May of this year.

As the respected business portal Kinibiz put it:

“Not only is the fund’s RM7-billion investment in the Cayman islands out of its control, but its RM877-million pre-tax profit for FY13 was merely paper gains as RM2.73 billion in property revaluation offset RM1.8 billion in actual losses. Impairment of goodwill is another cause for concern as far as 1MDB’s estimations are concerned, said new auditors Deloitte. And not only did 1MDB overpay by RM1.2 billion for its power assets, but it was revealed that Abu Dhabi entity Aabar Investments and Ananda Krishnan-linked Tanjong have an option to take up a substantial part of 1MDB’s power assets. These on top of 1MDB’s strangely huge RM23-billion cash pile against debts of RM36 billion. Is 1MDB a disaster unfolding before our very eyes” [Mkini Biz 1MDB: an unfolding disaster]

This highly advantageous situation of Aabar Investments towards 1MDB (which is chaired by Riza’s step-Dad, the Malaysian PM and Finance Minister Najib Raza) makes Riza’s special relationship with its CEO relevant.

After all, IPIC was cited as the co-guarrantor of a bond issue by 1MDB for the purchase of Tanjong power handled by Goldman Sachs in a closed deal, which Sarawak Report holds a copy of.

Indeed, Goldman Sachs made an astonishing and unusual profit from this transaction, according to our earlier investigation.

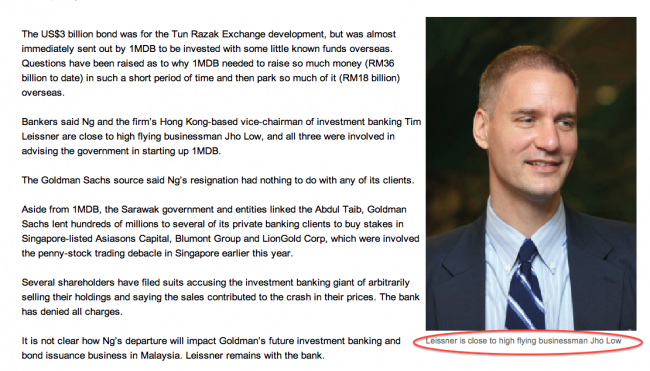

The leading figure for Goldman Sach’s Asian bond business with 1MDB Robert Ng has since recently quit his post to set up his own business.

However, as the financial press has pointed out, Ng had a reputation for high flying political connections and previously worked for Deustche Bank where he handled similar closed off-shore bond deals through Labuan for Taib Mahmud and SCORE.

Ng and his close partner at Goldman Sachs, Tim Leissner (who remains with the bank) have also been publicly noted for their close ties with Riza’s friend Jho Low.

It is Low who is acknowledged for setting up the whole concept of 1MDB in the first place, beginning with its fore-runner the Terengganu sovereign wealth fund.

Jho Low is a friend also of Riza’s mum, Rosmah Mansour, who is Najib’s wife. Indeed just in the past week it has been reported that Jho Low linked up with Rosmah and the PM on their European holiday trip, which they embarked on straight after Najib’s press conference in Amsterdam about the shooting down of the MAS airline over Ukraine.

Jho Low connection – Red Granite admits the links to Jho Low

In the New York Times article Aziz’s Red Granite partner, the American Joey McFarland, also finally admits his connection to Global Talent Booking, a firm that hires out celebrities, including Paris Hilton, for events.

McFarland also acknowledges that this was how he met Jho Low and that it was Jho Low who introduced him to Leonardo di Caprio, who was looking for funding for Wolf of Wall Street:

“After graduating from the University of Louisville, Mr. McFarland worked briefly for Chrysler’s finance arm in Cincinnati, then quit to focus on investments that included real estate and a restaurant.

Another investment, Mr. McFarland said, was in a talent brokerage company that booked performers and others into events. That, he said, led to travel, which in turn led to an acquaintance with Jho Low, a jet-setting Malaysian investor who had been a friend to Mr. Aziz during their student years in London.

Mr. Low, Mr. McFarland said, introduced him to Mr. Aziz. Somewhere along the way, Mr. Low introduced both to another acquaintance, Mr. DiCaprio, who proved willing to join forces if they could find a way to finance his favored projects.”[New York Times]

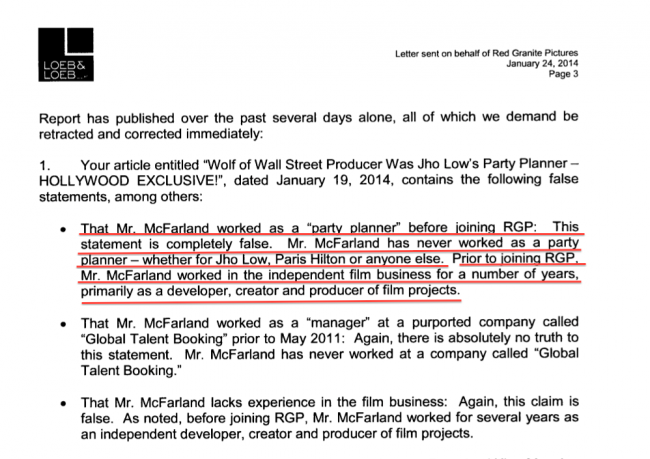

This is a completely different story to the one given to Sarawak Report in legal letters by Red Granite, in which he claimed it was libellous to say he had previously worked for a talent booking company/ party planner agency, because he had a long background in the film industry instead.

In his updated version to the New York Times, McFarland has admitted that he was indeed an investor in a ‘talent brokerage company’. And he made no claims to any past history in the film industry, citing a background in an estate agency and a restaurant prior to that.

Contrast this to McFarland’s earlier threats to sue Sarawak Report for reporting the fact that he worked for a talent booking company and that this was how he met Jho Low:

Note that in this legal letter in January McFarland claimed he had an extensive background in the film business – a claim which he no longer referred when speaking to the New York Times last week.

So, it is relevant to point out that Jho Low also has connections to Aabar Investments, whose chief executive has now emerged as the main funder of the rookie film duo behind Red Granite Pictures, namely Riza Aziz and Joey McFarland.

In a recent investigation Sarawak Report exposed how Low had dragged in 1MDB as a promised backer for his bid to buy out the London Claridge’s Hotel chain for over a billion dollars. 1MDB even invested tens of millions of euros in purchasing debt in a move designed to leverage Jho Low’s position in a rival bidding war.

This is despite the fact that Jho Low and 1MDB have consistently denied any business connections.

We can now further reveal that Low’s company Wynton was also being backed in this deal by Aabar Investments, according to a judgement on the matter by the British judge Justice David Richards:

This link has been clarified by Jho Low himself in a recent statement responding to Sarawak Report’s revelation that he had engaged in the attempted by-out with backing from 1MDB. In the statement Jho Low acknowledged he was in business with Aabar Investments and 1MDB:

“Mr. Low was a co-investor and led the coordinating efforts for the proposed bid for Maybourne Hotel Group (Claridge’s, the Connaught and the Berkeley in London) along with Aabar Investments PJS (an Abu Dhabi Government controlled sovereign wealth fund entity). 1Malaysia Development Berhad (1MDB) was one of the several investors invited by Aabar Investments PJS to evaluate this early-stage investment opportunity in 2010/2011. To facilitate the bid, some initial interested investors provided preliminary letters of intent in support of the bid.” [Media Statement by Jho Low]

These facts, therefore, clearly establish the links between Red Granite’s acknowledged major financier and Riza Aziz’s party-loving friend Jho Low.

It also establishes the links between Red Granite’s source of finance and the Malaysian wealth fund 1MDB, which is supervised by Riza’s step-father, the Malaysian PM Najib Razak.

The previous denials by Red Granite have now been rectified in this respect and it is therefore unsurprising that the threats in two legal letters to sue Sarawak Report were never carried out.

Given the nature of these links, a fuller explanation of the detail of Riza Aziz’s dealings with Mr Al-Husseiny is surely now required in the interest of the Malaysian public, who are funding 1MDB?