Sarawak Report has obtained more shocking emails written by the PM’s crony businessman Jho Low in 2011.

The emails detail an insider trading conspiracy, in which Low cites the support of “HE Prime Minister of Malaysia” in a scheme to net USD500 million.

The conspiracy was hatched in April 2011, according to the email trails in our possession.

The plan was to orchestrate a quick flip sale of RHB bank shares owned by the Abu Dhabi Commercial Bank (ADCB), in the full knowledge that two of Malaysia’s own banks CIMB and Maybank were in the process of seeking a merger with RHB.

Using their insider knowledge and the controlling influences of the Malaysian authorities, Jho Low and his business partners, who were the UK based investor Robert Tchenguiz and the then Chairman of Abu Dhabi’s Aabar fund, Khadem Al Quubaisi, expected to profit by at least half a billion US dollars.

This was to be at the expense of the Abu Dhabi public bank and the two Malaysian banks, expected to eventually buy the 25% share of RHB.

Writing to Tchenguiz 31st May 2011 Low gloated at the prospect of a 50:50 deal on a USD500 million dollar profit:

“Now that the MayBank & CIMB process is happening simultaneously, we can be sure our exit will be likely faster within 6 to 18 months…

Our lawyers are drafting up the USD100 million first lose guarantee for 24 months (with a 12 month extension) to be issued in favour of Aabar in return for a 50:50 net profit equal share so that our interests are mutually aligned in this partnership…

…. Our expectation is a minimum of USD500m net-profit for us jointly within 18 months or less.”

The most shocking aspect of this illegal plan was that Jho Low’s emails claimed he had the knowing consent of the PM at every stage, leaving glaring questions as to the PM/ Finance Minister’s level of involvement in the plot:

31st May 2011

“I had a meeting with HE Prime Minister of Malaysia (“HE PM”) this evening whom has subsequently spoken to the Central Bank Governor and the following has been established:

Malaysian Government Position:

Once ADCB Board approves to sell its stake to Aabar at 2.2x Q1 2011 book, both ADCB and Aabar will write in simultaneously to the Central Bank of Malaysia (“BNM”)to request for approval to negotiate…..

“It is important to put pressure on ADCB Board to ensure they agree on our price and that they only write to BNM for approval to negotiate with Aabar and not the other bidders”….

“HE PM and BNM Governor has agreed that Abu Dhabi will first be allowed to sell its 25% stake in ADCB to Aabar prior to the CIMB/MayBank bidding war to take-over or merge with RHB Bank occurring. Even in the event of a merger, Aabar’s shares in RHB Bank would be underwritten or taken-out”..

I would recommend…..Goldman Sachs (Asia) for International Advisory since they .. can quickly assist in the 2nd sale from Aabar to Maybank/CIMB.”

wrote Low in a devastating 3 page email (see below) which was forwarded to a number of contacts, in which he detailed the plot to quick flip the RHB shares through a “2nd sale” to the Malaysian banks, who were being excluded from bidding directly with ADCB.

I had a meeting with HE Prime Minister of Malaysia evening

The most sensational aspect of this blatant and greedy wheeler-dealing is Jho Low’s open email confession to his business partners that he was carrying out this attempted raid on publicly owned banks at the behest of the Malaysian Prime Minister cum Finance Minister, Najib Razak.

The emails in our possession were sent between April and June of 2011 and they predicted the pattern of subsequent transactions, which later took place.

ADCB (Abu Dhabi Commercial Bank) sold their 25% share of RHB to the sovereign wealth fund Aabar at the very moment that CIMB/MayBank set about their attempted merger with the bank.

And within weeks of the buy up Aabar was attempting to profit by selling on those shares to the parties to the merger.

In the first communication between the collaborators obtained by Sarawak Report, Tchenguiz contacted Aabar’s Khadem al Quubaisi (who has now been recently sacked as a result of related scandals) on 20th April 2011 to say that Jho Low had “alerted” him to “an opportunity” on a trade valuing around USD$2 billion:

“National Bank of Abu Dhabi is currently a 25 per cent shareholder in the 4th largest Malaysian bank called RHB… Jho Low has alerted us about this opportunity. The trade is circa 2b dollars” wrote Tchenguiz.

Research by Sarawak Report has shown that this introduction by Tchenguiz of the well-connected Malaysian Jho Low to the Aabar fund manager soon sparked a frenzy of mutual activity between the two men.

The pair embarked on numerous deals involving Aabar, backed by 1MDB, all of which provided ample opportunities for large private commissions to Jho Low companies.

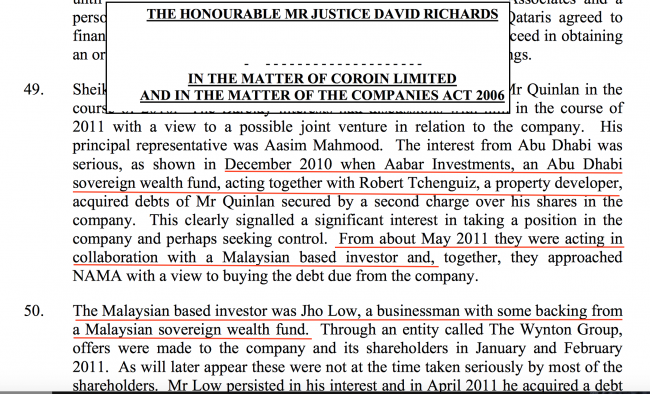

Indeed, by the following month, according to a British court judgement, Aabar, Jho Low and 1MDB were already tying together over a multi-million dollar deal to buy out a London Hotel group.

Again, the link was Tchenguiz:

Over subsequent years and months 1MDB engaged in a pattern of deals raising money through Aabar, all of which have contributed to the present parlous position of debt at the development fund.

HE PM has agreed… BNM will approve within 24 hours

We can now reveal the full extent of Jho Low’s plan to quick flip the RHB shares, which was laid out in a 3 page email (below) sent by Jho Low on 31st May 2011 entitled “Updates Re Project Red Transaction”. The email was eventually forwarded to a number of related contacts.

As a former senior officer at ADCB himself Al Quubaisi was clearly being addressed as someone who could still exert influence on the decisions of the shareholder bank, while controlling the buyer Aabar as well, through his role as then Chairman.

Jho Low explained how the well-positioned conspirators would use their combined influence to secure an advantageous trade on the RHB shares, thanks to the stated support of the Malaysian Prime Minister, who would prevent other parties from buying up the shares, even if they came in with a higher bid.

According to Low’s email, the PM was agreeing to support the Aabar bid, based on the calculation of a future “2nd sale from Aabar to MayBank/CIMB”.

This was even though Jho Low said that he “confidentially” knew a number of other banks were prepared to pay “much higher” than Aabar for the shares, so they needed to be kept out of the picture.

Facade for PR purposes?

The Penang businessman, whose close links to Najib and the investment decisions of the failing development fund 1MDB are now the subject of growing national and international scandal, also said the PM had collaborated in a decision to stage a public event in June in Kuala Lumpur.

This was in order to present the Aabar purchase in a positive PR light for his government:

“He PM has indicated he would like a MOU/Binding Term Sheet/SPA signed subject to relevant approvals in conjunction with HH Crown Prince of Abu Dhabi’s official visit to Malaysia on 16/17th June 2011 and will formally invite Aabar and IPIC [parent fund] senior officials.

[this] is important for HE PM as it will show that Abu Dhabi is committed in investing in Malaysia with Aabar’s USD2b transaction in RHB Bank.

Yet, the rest of the email implies that the PM was well aware that Aabar was not ‘committed’ at all and was planning instead to make a lightening profit at the expense of Malaysia’s own banks, which were being prohibited from engaging in the first stage of the buy-out.

One of these two victim banks was of course none other than CIMB, whose Chairman is Najib Razak’s own brother.

“Project Robbie” was the code name adopted by Jho Low for this transaction in the 3 page email, which is reproduced below:

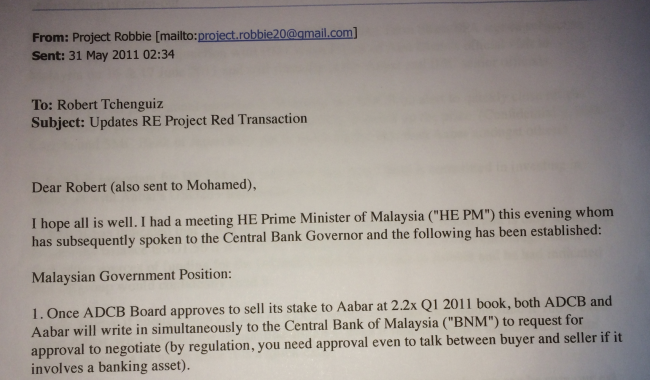

From: Project Robbie [[email protected]]

Sent: 31 May 2011

To: Robert Tchenguiz

Subject: Updates RE Project Red Transaction

Dear Robert (also sent to Mohamed),

I hope all is well. I had a meeting with HE Prime Minister of Malaysia (“HE PM”) this evening whom has subsequently spoken to the Central Bank Governor and the following has been established:

Malaysian Government Position:

1. Once ADCB Board approves to sell its stake to Aabar at 2.2x Q1 2011 book, both ADCB and Aabar will write in simultaneously to the Central Bank of Malaysia (“BNM”)to request for approval to negotiate (by regulation, you need approval even to talk between buyer and seller if it involves a banking asset)

It is important to put pressure on ADCB Board to ensure they agree on our price and that they only write to BNM for approval to negotiate with Aabar and not the other bidders.

– To this, I would recommend:

(a) Wong & Partners (correspondence firm of Baker & McKenzie) which is the best law firm in Malaysia (as foreign firms are not allowed to operate in Malaysia). They have represented international clients in numerous banking transactions in Malaysia.

b)Goldman Sachs (Asia) for International Advisory since they have assisted RHB Bank and its shareholders many times in running bid processes so they can quickly assist in the 2nd sale from Aabar to Maybank/CIMB.

c) AmBank for Malaysian Financial Advisory (required for Malaysian regulations when doing the 2nd transaction)

2. BNM will approve this request within 24 hours.

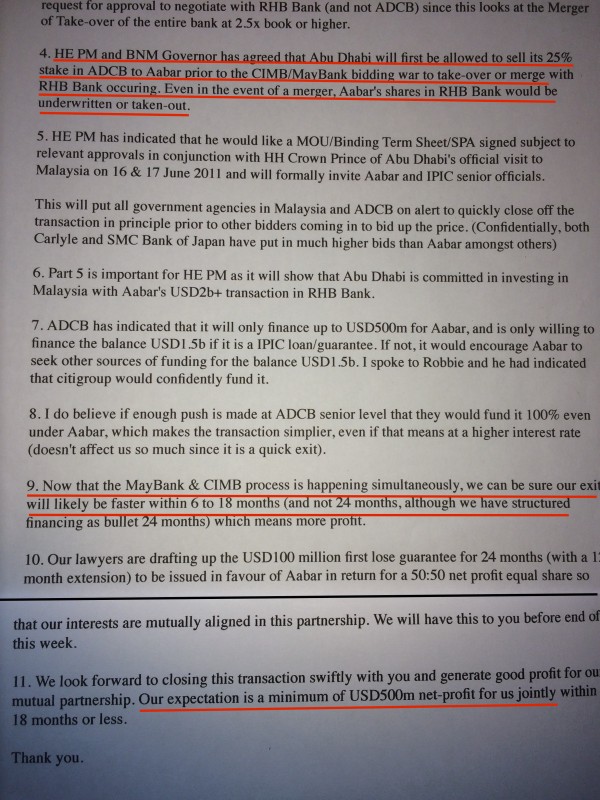

3. HE PM has approved for MayBank (Malaysia’s largest banking group owned by PNB, a gov owned intstitutional fund) and CIMB Bank (Malaysia’s second largest banking group owned by Khazanah, a gov owned sovereign wealth fund) both to submit their letters to BNM today to request for approval to negotiate with RHB Bank (and not ADCB)since this looks at the Merger of Take-over of the entire bank at 2.5x book or higher.

4.HE PM and BNM Governor has agreed that Abu Dhabi will first be allowed to sell its 25% stake in ADCB to Aabar prior to the CIMB/MayBank bidding war to take-over or merge with RHB Ban occurring. Even in the event of a merger, Aabar’s shares in RHB Bank would be underwritten or taken-out.

5. HE PM has indicated that he would like a MOU/Binding Term Sheet/SPA signed subject to relevant approvals in conjunction with HH Crown Prince of Abu Dhabi’s official visit to Malaysia on 16 & 17 June 2011 and will formally invite Aabar and IPIC senior officials.

This will put all government agencies in Malaysia and ADCB on alert to quickly close off the transaction in principle prior to other bidders coming in to bid up the price. (Confidentially, both Carlyle and SMC Bank of Japan have put in much higher bids than Aabar amongst others)

6. Part 5 is important for HE PM as it will show that Abu Dhabi is committed in investing in Malaysia with Aabar’s USD2b transaction in RHB Bank.

7. ADCB has indicated that it will only finance up to USD500m for Aabar, and is only willing to finance the balance USD1.5b if it is a IPIC loan/guarantee. If not, it would encourage Aabar to seek other sources of funding for the balance USD1.5b. I spoke to Robbie and he had indicated that citigroup would confidently fund it.

8. I do believe if enough push is made at ADCB senior level that they would fund it 100% even under Aabar, which makes the transaction simpler, even if that means at a higher interest rate (doesn’t affect us so much since it is a quick exit).

9. Now that the MayBank & CIMB process is happening simultaneously, we can be sure our exit will likely be faster within 6 to 18 months (and not 24 months, although we have structured financing as bullet 24 months) which means more profit.

10. Our lawyers are drafting up the USD100 million first lose guarantee for 24 months (with a 12 month extension) to be issued in favour of Aabar in return for a 50:50 net profit equal share so that our interests are mutually aligned in this partnership. We will have this to you before end of this week.

11. We look forward to closing this transaction swiftly with you and generate good profit for our mutual partnership. Our expectation is a minimum of USD500m net-profit for us jointly within 18 months or less.

Thank you

Team of seasoned operators

Notably, in this shockingly explicit email Jho Low recommended using a raft of professionals, who had already engaged in suspect deals with himself and 1MDB or were about to enter future highly contentious deals.

These included the law firm Wong & Partners, who had nodded through his billion dollar heist in 2009 against 1MDB, using the joint venture deal with the company PetroSaudi.

Also the bankers Goldman Sachs, who were later to cause uproar over their secret commission charges for raising funds for 1MDB power purchases (again in collaboration with Aabar and Al Quubaisi).

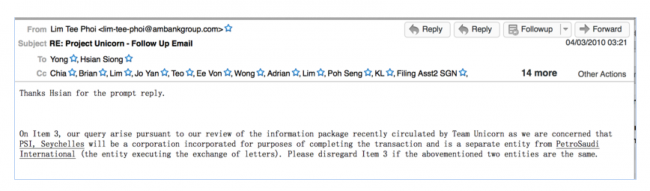

AmBank too was recommended by Low to take part in the deal. This was the bank involved in the earlier purchase of UBG group. At the time AmBank had raised concerns that the vehicle being used for the buy-out, PetroSaudi Seychelles, had no actual connection with the PetroSaudi International group, as was being claimed.

Yet the bank nevertheless accepted a dubious excuse for this illegal transgression, which was that Prince Turki bin Abdullah needed to avoid publicity.

The real reason, as Sarawak Report has amply demonstrated, was that the money used to buy out UBG had come from 1MDB and not PetroSaudi.

Thanks Hsian for the prompt reply.

On Item 3, our query arise pursuant to our review of the information package recently circulated by Team Unicorn as we are concerned that PSI, Seychelles will be a corporation incorporated for purposes of completing the transaction and is a separate entity from PetroSaudi International (the entity executing the exchange of letters). Please disregard Item 3 if the abovementioned two entities are the same.

The introduction of Javace is fine as long as it’s a nominee of the entity executing the exchange of letters.

Thanks and Regards,

LIM TEE PHOI 林子沛

Corporate Finance & Advisory 企业融资与咨询

AmInvestment Bank Berhad 大马投资银行

(A member of AmInvestment Bank Group)

21st Floor, Bangunan AmBank Group

55 Jalan Raja Chulan

50200 Kuala Lumpur

Tel : 03 – 2036 1204 (direct)

Fax : 03 – 2070 8596

From: Yong, Hsian Siong [mailto:[email protected]]

Sent: Thursday, 04 March, 2010 10:37 AM

To: Lim Tee Phoi

Cc: Chia, Brian; Lim, Jo Yan; Teo, Ee Von; Wong, Adrian; Lim, Poh Seng; KL, Filing Asst2 SGN; [email protected]; [email protected]; [email protected]; Jeanie Lim Lai Ling; Sharon Chung Lai Wan; Joanna Yu Ging Ping; Alexander Hoh Yoon Choong; Daniel Lee Soon Heng; Jeanie Lim Lai Ling; Kok Kim Yin; Lim Wui Hoong; [email protected]; Project Unicorn; [email protected]

Subject: RE: Project Unicorn – Follow Up Email

Dear Tee Phoi

We refer to your email below and write to provide our response to your query in Items 2 and 3 below.

Item 2

As the memorandum was already finalised following discussions with Am previously, we will be happy to provide you a signed copy of the memorandum to be included in the information to be provided to the SC for your further action.

Item 3

From the information and documents provided to us, we note that the entity issuing the offer letters was PSI International Ltd (Seychelles) (“PSI Seychelles”) and the offer letters to CHSB, PPES and MMSB provide that PSI Seychelles may make the relevant acquisitions, directly or indirectly. As you are aware, Javace Sdn Bhd will be the entity carrying out the exercise and as a subsidiary of PSI Seychelles, is the “nominee” of PSI Seychelles.

Team Unicorn has also provided information that Sheikh Tarek is the sole shareholder of PSI Seychelles and that is the relationship between the 2 parties. In that regard, we are unsure as to why there would be a query as to whether or not PSI Seychelles is a nominee of Sheikh Tarek and consequently, no question as to the invalidity of the transfer of shares to Javace Sdn Bhd, the nominee of PSI Seychelles carrying out the exercise.

********************

We trust this email is responsive. Please do not hesitate to contact us should you wish to discuss the above in more detail.

Best regards,

Hsian / Ee Von

Yong Hsian Siong

Partner

Wong & Partners

Level 21, Suite 21.01

The Gardens South Tower

Mid Valley City

Lingkaran Syed Putra

59200 Kuala Lumpur

Tel : 603 2298 7888

Fax: 603 2282 2669

Direct: 603 2298 7861

[email protected]

Wong & Partners is a member of Baker & McKenzie International, a Swiss Verein.

_____

From: Lim Tee Phoi [mailto:[email protected]]

Sent: Wednesday, March 03, 2010 5:53 PM

To: Lim, Jo Yan; Project Unicorn; [email protected]

Cc: Chia, Brian; Yong, Hsian Siong; Teo, Ee Von; Wong, Adrian; Lim, Poh Seng; KL, Filing Asst2 SGN; [email protected]; [email protected]; [email protected]; Jeanie Lim Lai Ling; Sharon Chung Lai Wan; Joanna Yu Ging Ping; Alexander Hoh Yoon Choong; Daniel Lee Soon Heng; Jeanie Lim Lai Ling; Kok Kim Yin; Lim Wui Hoong; [email protected]

Subject: Project Unicorn – Follow Up Email

Dear Team Unicorn,

We wish to bring your attention to the following matters (as we intend to arrange for the SC consultation by next week. Appreciate if the relevant parties could revert on the said matters latest by end of this week) :-

- Pricing of Downstream Entities

Reference is made to our previous meeting in January 2010 whereby we have discussed on the take-over prices to be accorded to both downstream entities (i.e. Putrajaya Perdana and Loh & Loh).

In this respect, will the pricing for BOTH downstream entities remain at RM4.85 per share each OR whether the offeror has the intention to revisit the pricing.

It should be noted that since the last meeting, the market prices of both entities have increased and that the unaudited 12-months results (for FYE 31 Dec 2009) have also been announced (with a higher EPS achieved). These may be factors the offeror may wish to take into consideration. Nonetheless, we have enclosed herewith the revised pricing sheet for your kind attention.

- Consultation with the Securities Commission

As previously discussed, we will be arranging for a consultation session with the SC on matters pertaining to treating such UBG shares acquired (by PSI) either under MMSB and CMS transaction as “offer shares” thus qualifying either of them towards the computation of the 90% threshold for purposes of compulsory acquisition.

Prior to the consultation, the SC would require the legal memorandum from Wong & Partners be finalized and provided. Additionally, the SC may also require further information on matters relating to the downstream pricing. As such, we would appreciate if Team Unicorn could finalize item (1) above soonest possible.

- Identity of Offeror

Based on the information package circulated by Team Unicorn on 23 Feb 2010, we noted that PSI (Seychelles) will now be the holding company of Javace and Sheik Tarek Obaid is the sole shareholder of PSI (Seychelles). It is also noted that PSI (Seychelles) is not an entity connected to PetroSaudi International Ltd (which was the party executing the exchange of letters with MMSB and CMS) apart from both of them having a common shareholder in Sheik Tarek. In order for the take-over exercise to proceed, presumably PSI (Seychelles) will be completing the MMSB/CMS transactions and thereafter undertaking the take-over obligation.

Whilst we note that the exchange of letters allow for the transaction to be completed via a “nominee of PetroSaudi International Ltd”, will PSI (Seychelles) be considered as a nominee of Sheik Tarek instead of PetroSaudi International Ltd and consequentially the transfer of UBG shares to PSI (Seychelles) being void?? Wong & Partners, appreciate your views on this matter.

On another note, we will be circulating the latest notices of take-over as well as the submission appendices which requires Team Unicorn and the 3 PLCs’ feedbacks by tomorrow. For the 3 PLC info, appreciate Team Unicorn to assist in on-sending the same to the relevant parties in the PLC (we shall indicate within the email tomorrow).

Thanks and Regards,

LIM TEE PHOI 林子沛

Corporate Finance & Advisory 企业融资与咨询

AmInvestment Bank Berhad 大马投资银行

In a separate email trail an AmBank employee explained and accepted the excuses given by PetroSaudi directors for the illegal subterfuge, presumably sealing its position as a partner for Jho Low’s approach to business:

Subject:Javace Sdn Bhd – Conference Call with PSIL, Javace, OCBC and AmBank

From:”Daniel Lee Soon Heng” <[email protected]>

Date:04/05/2010 14:02

To:Ong Eng Bin; Chong Lee Ying; [email protected]; Project Unicorn; [email protected]; Chun Jiet Ong; [email protected]

CC:Joanna Yu Ging Ping

Dear Patrick, Choh Hun, Chun Jiet, Eng Bin & Lee Ying,

The conference call concluded earlier this evening between the representatives of AmBank, OCBC Bank and PSIL (represented by Patrick Mahony, Geh Choh Hun & Ong Chun Jiet) refers.

For ease of reference of all participants in the call, please find below a brief recap of the issues discussed during the call (and please feel free to highlight any additional comments / issues in relation to the conference call which may have inadvertently been omitted) : –

θ Brief introduction by PSIL on the ongoing developments in the Kingdom of Saudi Arabia (“KSA”) in relation to infrastructure development plans – in the region of USD500bn over the next 5 years. These plans are part of the KSA’s ongoing efforts to diversify their economy away from O&G / Petroleum base….

θ In relation to the corporate structure of PSI: It was noted that the GO Exercise is being undertaken by PSI, Seychelles which is wholly owned by Sheik Tarek Obaid (“TO”), i.e. no direct link to PSI, Saudi Arabia. Patrick shared that given the political sensitivity of PSI, Saudi Arabia (i.e. involving members of the Saudi Royal Family), transactions involving public listed companies are typically undertaken in this manner, i.e. with TO acting as the representative of PSIL for the transaction and minimising unnecessary exposure of the Royal Family to scrutiny and press.

θ In relation to issue of margin of financing: PSIL’s preference would be to maintain the current proposed financing structure with debt financing amounting to RM825m. In view of the status of its ongoing discussions, PSIL is confident of securing a strategic investor wherein PSIL expects the debt to be pared-down ahead of the pre-determined repayment schedule. In addition, Patrick highlighted the recent G2G dealings between Malaysia and KSA and that the GO Exercise is seen by PSIL to be the first of many transactions in Malaysia. Accordingly, Lenders under the Facility would be expected to view the transaction as the commencement of relationship with the PSIL group with expectation of further reciprocal business going forwards…

θ In relation to potential capitalisation requirement on PPB and LLCB: Given PSIL’s confidence in its ability to secure sizeable construction projects in KSA, OCBC highlighted possibility that additional funding / capitalisation from PSIL would be required to fund at least at initial stage. However, PSIL informed that such contracts in KSA typically include advance payment / mobilisation monies and accordingly would not be expected to require additional funding for these activities in KSA.

θ In relation to PSIL tie-up with 1Malaysia Development Berhad: The PSIL-1MDB JV was unlikely to be involved directly with the GO Exercise / UBG Group. However, PSIL confirmed that intention of the JV would include investments within Malaysia.

θ Request for PSIL to procure letter of support from bankers: PSIL would be able to furnish a letter of good standing from its bankers (e.g. JP Morgan). PSIL would also procure a letter of good standing in relation to TO. However such letter of good standing would not include an indication of quantum of said bank’s dealings with PSIL given the sensitive nature of such information / privacy requirements of the Royal Family.

Insider traders

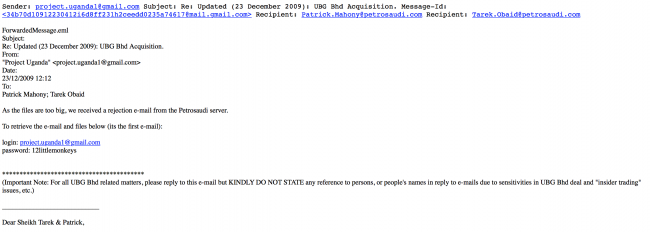

Yet the role of all these partners ought now be investigated. At the time of this UBG deal in 2010, dubbed Project Uganda, Jho Low had made clear why he favoured code names for such projects:

” KINDLY DO NOT STATE any reference to persons, or people’s names in reply to e-mails due to sensitivities in UBG Bhd deal and “insider trading” issues, etc.)” he warned in an email entitled “Updated – UBG Bhd Acquisition”:

Sender: [email protected] Subject: Re: Updated (23 December 2009): UBG Bhd Acquisition. Message-Id: <[email protected]> Recipient: [email protected] Recipient: [email protected]

Subject:Re: Updated (23 December 2009): UBG Bhd Acquisition.

From:”Project Uganda” <[email protected]>

Date:23/12/2009 12:12

To:Patrick Mahony; Tarek Obaid

login: [email protected]

password: 12littlemonkeys

*****************************************

(Important Note: For all UBG Bhd related matters, please reply to this e-mail but KINDLY DO NOT STATE any reference to persons, or people’s names in reply to e-mails due to sensitivities in UBG Bhd deal and “insider trading” issues, etc.)

Dear Sheikh Tarek & Patrick,

Please find attached:

- PetroSaudi International Ltd (“PSI”) Seychelles (“PSIS”):

– Register of Members (please note it is a bearer share, and currently the bearer share is dated 7 October 2009 held by Sheikh Tarek Royal Family of KSA)

– Bearer Share certificate, etc. (date of incorporation of PSI Seychelles is also 7 October 2009)

– M&A of PSI Seychelles

– The current director of PSI Seychelles is a nominee director company provided by OIL, please let us know if this is to be changed to Sheikh Tarek or Patrick (suggestion is perhaps Patrick is made the sole director as this point since there will be a lot of documents to be signed by both the SPV Sdn Bhd (100% owned malaysian company by PSI Seychelles) and PSI Seychelles), but will leave it to your advice. Please kindly reply to this e-mail to advice.

- PSIS resolution for UBG Deal – we assumed Patrick would be the sole director of PSIS, but if this is decided to be Sheikh Tarek, please update this document accordingly

- Acquisition of UBG Shares

- PSIS will issue this letter (but the actual transaction at a later stage can be done by its nominee company, i.e. SPV Sdn Bhd)

– PSIS to MMSB via a direct business transaction (main stake 52%) (1st tranche)

– PSIS to CHSB (stakes owned by the Chief Minister of Sarawak) via their acceptance during the General Offer (2nd tranche)

– PSIS to PPES (stakes owned by the Chief Minister of Sarawak) via their acceptance during the General Offer (2nd tranche)

- PSIS will issue this letter to CMS to agree to vote to sell CMS Roads Pavements (its a government concession and thus can’t be owned by foreign companies). The sale price is exactly the same as the cost of UBG/Putrajaya Perdana’s acquisition price so it is 100% fair (please refer to the excel sheet for calculations). This sale will also raise cash for the UBG Group of companies.

IMPORTANT: Please kindly sign the part 2, part 3 letters of 3a and 1 letter of 3b (please do not change the dates as later dates were inserted, 29 December 2009 to ensure that we have sufficient time to prepare the offer documents, etc.) – 6 documents in total. Please scan and e-mail letters to this e-mail once done.

Owned by the Chief Minister of Sarawak

The above email from Jho Low also significantly referred to shares in UBG as being “stakes owned by the Chief Minister of Sarawak”.

Abdul Taib Mahmud (who remains the present Governor of the state) was the first leading political figure to develop a close relationship in Malaysia with Jho Low, even though he has always maintained that he has never “done business” in Sarawak.

What better evidence that Taib’s denials are lies, than this statement from his business colleague on the then Board of Directors of UBG?

Our latest information about similar activities over the RHB Bank buy out merits a thorough investigation over how decisions were being taken by the Finance Ministry and the influence being exerted by Jho Low.

Sting in the tale

The RHB deal has nevertheless turned out to be far less immediately lucrative than Jho Low had promised his business partners.

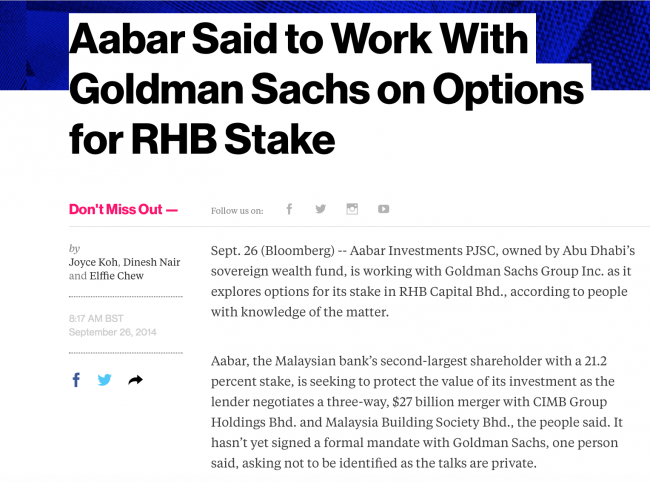

True to their original plans, by September of 2011 it was duly being reported that Aabar was indeed working with Goldman Sachs on the planned ‘2nd sale’, which it described as an attempt to “protect itself” from the ‘merger war’.

However, it soon became clear the cunning trade was falling flat, as the price of RHB shares plunged below Aabar’s buy up price:

“Aabar bought its RHB stake from Abu Dhabi Commercial Bank PJSC for 10.80 ringgit per share in 2011, when RHB was the target of a takeover battle between the country’s biggest lender Malayan Banking Bhd. and CIMB. RHB shares traded at 8.86 ringgit at 3:07 p.m. today in Kuala Lumpur, 18 percent below Aabar’s purchase price.[Bloomberg]

Over coming months Aabar’s determination to sell way above, instead of way below, its purchase price started to derail the merger deal and Aabar’s planned profit.

And by the end of 2014 the struggle was continuing as Aabar was still insisting on a higher price than market value:

Deals |

Abu Dhabi state fund asks for more in $22 billion Malaysia banking deal

DUBAI/KUALA LUMPUR |Aabar Investments is demanding a hefty premium for its minority stake in Malaysia’s No.4 bank, sources say, as the Abu Dhabi state fund leverages on its amplified role in a $22 billion merger that will create Southeast Asia’s fourth-largest lender.When the Malaysian stock exchange last week barred the Employees Provident Fund (EPF) from voting on a plan to merge CIMB Group Holdings (CIMB.KL), RHB Capital Bhd (RHBC.KL) and Malaysia Building Society Bhd (MBSB) (MBSS.KL) due to the state pension fund’s majority ownership in the three lenders, the spotlight was suddenly thrown onto secondary shareholders.

Aabar [INPTVA.UL], which owns 21 percent of RHB, wants its stake in the bank to be valued at 11-12 ringgit per share, sources familiar with the deal said. That would be as much as 11 percent more than what Aabar paid three years ago for its RHB holding and above the value placed on RHB of 10.03 ringgit per share in the proposed merger.[Reuters]

In the event, it seemed that the PM’s brother and the head of CIMB proved simply unwilling to pay out his shareholders’ money on Jho Low’s quick flip profit:

“ADCB and Aabar tried to force Maybank and CIMB to fork out the money with the 10.80 ringgit bid, but they didn’t realise that they would walk away,” [an industry insider told Arabian Business Mag]

So, by the start of 2015 it appeared that the sale and merger talks had gone the way of many planned financial deals in the wake of plummeting confidence over Malaysia’s economy and 1MDB.

Relations between the PM cum Finance Minister and his brother in charge of CIMB have been publicly frosty in recent months.

Could this episode have had something to do with it?