As international investigators circle the affairs of 1MDB, Sarawak Report can reveal a new and excruciating development for Malaysia’s Prime Minister.

It relates to the unexplained figure of US$170 million, which we have earlier reported was paid by a company owned by the businessman Jho Low into Najib’s AmBank account in late 2011.

Devastatingly, it has now emerged that the very same unusual sum was paid out during the same period by the company SRC International, a subsidiary of 1MDB, which has already been the focus of charges drawn up against Najib.

It raises an inevitable question as to whether the two transfers were connected?

Sarawak Report has obtained information that in November 2011 SRC International, which was managed by Nik Faisal Arif Kamil, a close associate of Jho Low, who is now hiding abroad, paid US$170 into an overseas account at the Swiss private bank Julius Baer.

Questions that need now to be answered are why was the money sent and where did it go next?

If these answers are not forthcoming there will be inevitable suspicion that the origin of the money that passed from Jho Low’s BVI company Blackstone Asia Real Estate Parters Limited into Najib’s KL account was indeed public money from SRC.

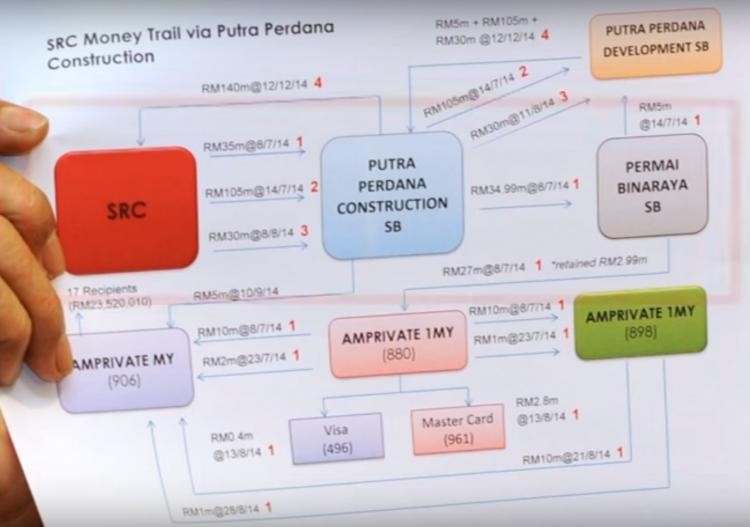

SRC , which was divested from 1MDB to the direct ownership of Najib’s Finance Ministry in February 2012, has been the subject of relentless controversy. It was originally set up as a subsidiary of 1MDB and took a RM4 billion loan from the public pension fund known as KWAP in 2011.

Opposition politicians have persistently demanded to know how this money has been invested and why the company’s accounts have been regularly delayed and so lacking in transparency?

When the Prime Minister/Finance Minister finally answered questions last year on SRC he repeated the claim that most of the money had been invested in Mongolia. However, Sarawak Report investigated and found that the value of the claimed coal mine investment could only amount to a fraction of the RM4 billion borrowed.

Growing SRC scandal

SRC has meanwhile been the focus of the Malaysian Anti Corruption Commission investigations into the missing billions from 1MDB, which have already identified two sets of payments totalling RM42 million and RM27 million, transferred within Malaysia from SRC to the Prime Minister’s AmBank accounts.

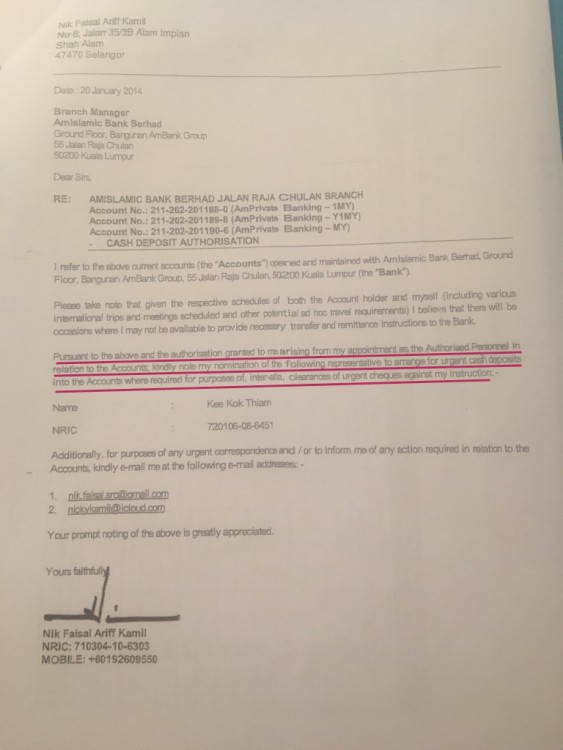

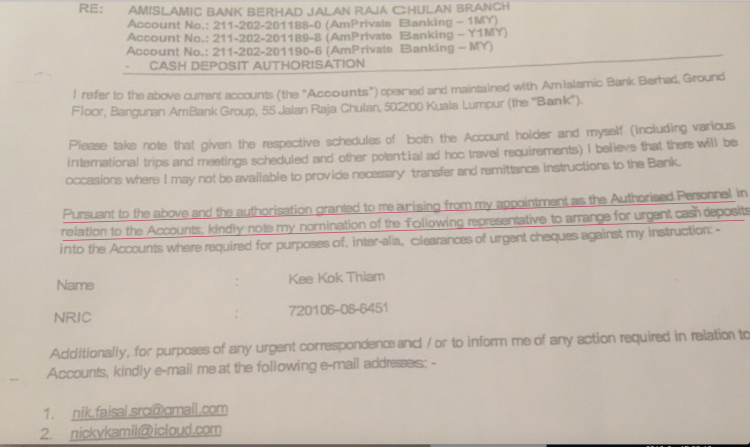

These payments were facilitated by Nik Faisal Arif Kamil, according to the evidence, and Sarawak Report has already provided documents to show that the Prime Minister had granted Kamil authorisation to manage these private AmBank accounts on his behalf.

This domestic investigation was sensationally closed last month, through a single-handed intervention by the new Attorney General, whom Najib had installed after unconstitutionally sacking his predecessor for drawing up charges against him relating to these transfers.

The hand-picked Attorney General has now been challenged on the matter by several legal figures and a growing number of police reports and law suits have been initiated against him for exceeding his authority in over-ruling the recommendation of the MACC that charges be brought.

The MACC has also stood its ground and appealed Apandi’s decision along with his announcement that the Prime Minister had been “cleared” of all charges on the basis that there was “no evidence” to show that money had been misappropriated from 1MDB.

The fact that a new international money trail has emerged, apparently also linking back to SRC, therefore introduces a further deadly dimension to the situation for Najib.

He might be able to shut down local investigations (albeit at the expense of the political turmoil that now besets Malaysia), however payments of dollars through the global banking system can be traced by outsiders.

The US and Swiss authorities are known to be working closely together on these matters and they are in a position to discover exactly where the money then went to from the Swiss Private bank, which has a branch in Singapore (where the authorities are also cooperating in the investigations).

If the sum that left SRC is not the same sum that entered AmBank account number 694 in KL belonging to the Prime Minister in 2011, therefore, this is the time for him to show the proof.

Blackstone Asia Real Estate Partners Limited (BVI)

Sarawak Report has already detailed the role of this BVI company in making payments not only to Najib, but to the other major player in 1MDB’s deals with the Abu Dhabi fund Aabar, its Chairman Khadem Al Qubaisi.

In 2012 KAQ, as he is known, received a staggering half billion dollars into his personal Luxembourg account at yet another private bank, Edmond de Rothschild banque privee, paid by Blackstone Asia Real Estate Partners Limited (BVI).

Plainly named to appear as if it were linked to the major US Blackstone fund BAREPL is framed in the classic mould of a series of off-shore companies set up by Low to launder money.

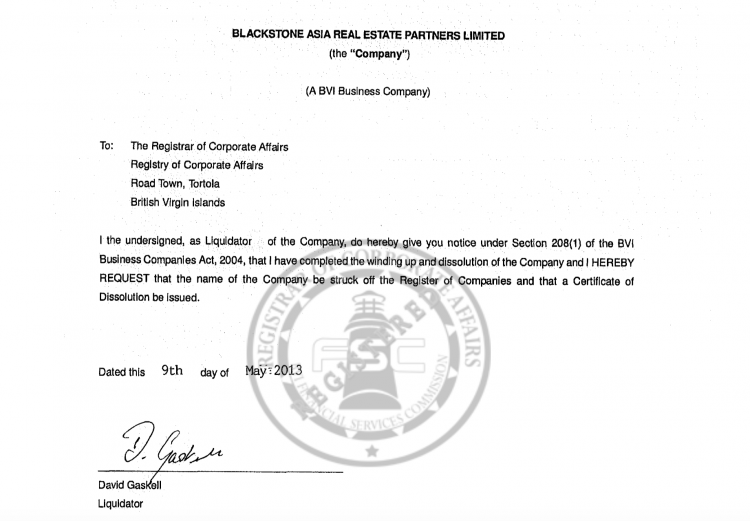

It had been incorporated in November 2010 and was liquidated in May 2013, shortly after the Malaysian General Election.

Sarawak Report has already reported that US$170 million was transferred from this company to the same AmBank account belonging to the Prime Minister that later received US$681 million in March 2013.

Sources close to the investigation into 1MDB have also informed Sarawak Report that the registered manager of Blackstone was the same Seet Li Lin, who was a key staffer for Jho Low and who also managed the company Good Star Limited, which received the initial US$700 million stolen from the 1MDB PetroSaudi join venture.

If, therefore, the US$170 million dollars that was paid into Julius Baer by SRC International in November 2011 was not then transferred, directly or indirectly, to Blackstone Asia Real Estate Partners Limited, which had an account with Standard Chartered Bank in Singapore and then on into the Prime Minister’s KL account, then this is surely the time for the Minister of Finance to explain what did happen to this missing US$170 million?

Growing headcount of banks embroiled in 1MDB scandal

Finally, this development has pulled yet another two major global banking institutions into the 1MDB money laundering scandal.

Julius Baer is the latest of a growing list of Swiss private banks which have allowed themselves to be utilised by politically exposed persons (PEPs) to transfer gobsmacking sums of money. Others are BSI, Coutts Zurich, JP Morgan Suisse and Falcon Bank.

Just last December the bank was fined half a billion dollars by the US authorities for assisting tax evasion by its wealthy clients.

The pivotal role of Singapore branches has also become glaring in this affair, with the major player Standard Chartered now also in the frame as the account holder for the plainly bogus Blackstone Asia Real Estate Partners Limited (BVI).

Add to the above Australia’s ANZ bank, the major shareholders and office holders in AmBank, and the US giant Goldman Sachs.

Najib’s foreign lobbyists are doubtless at work and spending Malaysia’s money to silence these international investigations, but signs are that the regulators and world media know far too much for a cover up to be sustainable.