MAJOR INVESTIGATION:

Criss-crossing the desert highways of the south western United States, Sarawak Report has identified a treasure trove of hidden plunder, stolen from the people of Sarawak by its despot Taib Mahmud and his timber cronies from Samling.

The treasure is in the form of vast land assets and investments, comprising major developments, mineral companies and enterprises in science and technology – all worth billions of dollars.

The contrast between Sarawak’s green canopies and the sucked-dry landscapes of Arizona and California could not be more pronounced.

However, we have discovered that it is here that much of the profit from the rainforest’s destruction has been invested, watering select slices of this insatiable desert to create new townships.

Estrella, Mountain House, Oro Valley are among the names of a string of ambitious ‘Masterplanned Communities’ funded as perfect laundering devices for this illegal cash siphoned from the opposite side of the planet.

Thousands of brand new houses, streets and malls, schools and community halls, set around artificial lakes in the blistering sunshine, advertise the ‘American Dream’ to eager in-comers, ignorant that their opportunity has come at the expense of the people of Sarawak and their rainforest.

Sarawak Report has toured the sales rooms and show homes on display in Arizona and California as a prospective buyer.

On offer street after street of expensive housing, currently under construction across several square miles of territory, designed for the ‘All American Family’ life.

They are mainly being bought by new arrivals from places like India and the Far East, beckoned by grand living spaces, super-modern kitchens, ensuite bedrooms, walk-in wardrobes, with barbecues, lakes and golf courses outside.

Sunchase Holdings

The investor behind these huge ventures is a massive private concern named Sunchase Holdings, which has already sold on many of these assets at a record-breaking profit, according to its own website.

Sunchase is now looking for further lucrative opportunities in America and Europe, it says.

“At the height of the real estate market, in 2005, SunChase completed the bulk sale of the balance of its residential holdings in Mountain House (8,400 lots) to Shea Homes, resulting in one of the largest real estate transactions in the history of Northern California.

SunChase continues to own approximately 400 acres of retail, office, industrial and multi-family parcels in Mountain House. [Sunchase website]

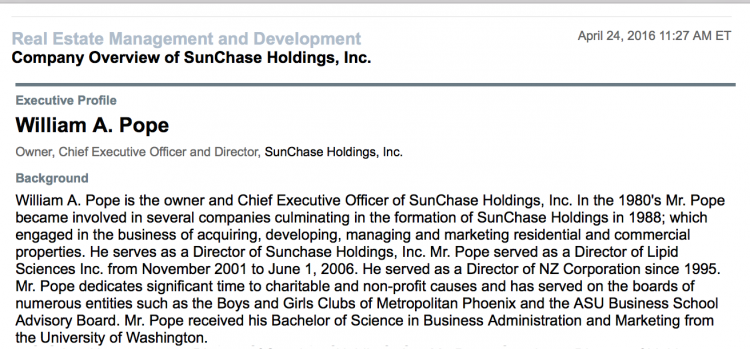

The CEO of Sunchase is one William Arthur (Bill) Pope.

He claims he is the owner of Sunchase and founded the company.

However, we have identified him as a long-term agent of the logging giant Samling and its ultimate controlling individual, the Sarawak Governor Taib Mahmud.

Research shows that over the past three decades the enterprise has invested billions of dollars in enormous developments, through a network of over 70 subsidiary companies in the United States, spanning new townships from Texas through to Colorado and even as far as Hawaii.

The company openly boasts (above) that its land assets consist of one of the largest land portfolios ever assembled in the United States.

Think about that.

Sunchase continues to brag that in 1993 theirs was the company, which was able to reach deep into its private pockets and slam a record US$2 billion cash on the table, in order to buy the largest slice of property ever sold by the United States Federal Government.

This was ‘distressed’ property, repossessed by the US government-controlled Resolution Trust Company, which was established to bail out America’s mortgage lenders during the so-called Savings and Loans crisis – the value of this land bought at rock bottom prices has since predictably rocketed:

Many of these interests have subsequently been sold on to secondary developers.

However, Sunchase remains very much a going and growing concern from the profits made. The corporation openly advertises its interest in new projects, in which it is willing to further invest giant sums of cash – its website solicits ‘Desired Investments’ into which it can put its money:

Sarawak Report has identified a number of major buy outs by Sunchase, including the former New Mexico and Arizona Land Company, which is a major mining concern, and a number of technology ventures, such as the California medical research company Lipid Sciences, now dissolved and a major online payment facility named INTRIX:

INTRIX Technologies, Inc., a wholly owned subsidiary, based in Sacramento, California. INTRIX is an industry leading software and transaction hosting company that specializes in full service payment processing systems for a variety of national and international corporate clients. [Sunchase website]

These massive investments have not escaped their share of controversy.

In particular, Sarawak Report has already exposed Samling/Sunchase as having been at the reported “epicentre” of the sub-prime mortgage scandal in 2007/8, owing to the record repossessions arising from properties sold on its development Mountain House in California.

Thousands of expensive houses were being sold to buyers for ‘step’ mortgages, which they were not able to ultimately afford – thereby helping to trigger the world financial crisis and leaving Mountain House with the unenviable status as the most “under-water” town in the whole of the United States.

Who owns Sunchase Holdings?

So, from where did all this wealth arise and to whom does it rightfully belong?

The long term President of Sunchase, the American, Bill Pope, currently proclaims on the company website that he was both the founder and owner of Sunchase.

He is presently the 100% owner of Sterling Pacific Assets, which is in turn the 100% owner of Sunchase Holdings, according to Arizona state records.

However, Sarawak Report’s research indicates that Pope was not the primary investor behind the company and therefore unlikely to be the ultimate beneficial owner.

To the contrary, the evidence shows that Sunchase was funded by the profits of timber corruption in Sarawak, authorised by Taib and channelled through Samling. Those assets should be therefore be restored, according to the foreign corrupt practices legislation of the United States.

Who is Bill Pope?

Bill Pope, aged 60, certainly lives a luxurious life.

He boasts a massive yacht called ‘Sunchaser’ and enjoys a hobby collecting expensive classic cars, for which he has created a private museum.

He lives in Paradise Valley – the place for rich folk in Phoenix, Arizona.

However, there are discrepancies over his advertised CV, according to research carried out by Sarawak Report.

Pope indicates that he obtained a Bachelor of Science in Business Administration and Marketing from the University of Washington, following which he set up a number of companies, “culminating” in Sunchase Holdings in 1988.

However, there is no record of Mr Pope at the Seattle based university, nor is there such a degree. The Business Administration and Marketing course comes under their Arts department instead.

William Pope also says he is on Arizona State University’s (ASU) ‘Business School Advisory Board’. However, the University appear not to be aware of this and nor do they actually have a Business School Advisory Board.

Neither are any of his company ventures prior to Sunchase listed by Mr Pope nor recorded in any public search, as one might expect, given the humungous deals and investments that company was immediately involved in during the 1990s.

In which case, Sarawak Report asks if William Arthur Pope, Arizona has any connection to the William Pope who was working in Miri for Tractors Malaysia during the 1980s, selling Caterpillar tractors to the state’s largest logging concern Samling?

Sarawak was the world’s biggest exporter of hardwood tropical timber throughout this period and the 1990s, as Taib Mahmud set about razing an entire hardwood jungle.

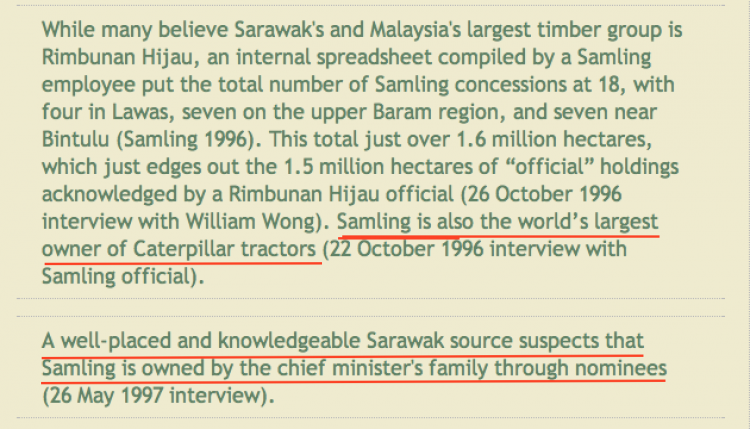

And Samling was the largest of the six crony logging companies then operating in Sarawak, thanks to the largess of timber licences handed out by Taib.

Samling was also the world’s single biggest corporate customer of Caterpillar trucks according to several sources, including its own global offering document in 2007.

Think about that.

Sarawak observers say that this Miri-based Mr Bill Pope developed a strong working relationship with his customers in Sarawak, specifically Samling’s Yaw family, who soon became listed amongst the richest individuals in South East Asia.

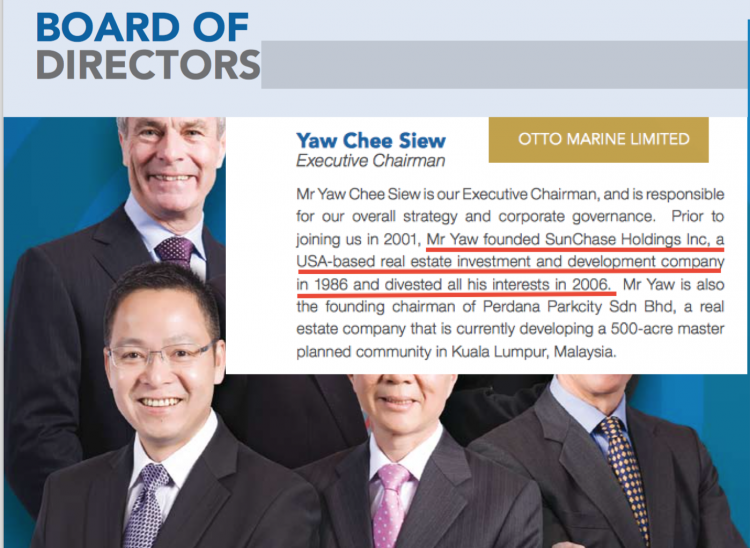

Whether or not this was the same William Pope who has ended up heading Sunchase, our research indicates that Sunchase was in fact founded and originally officially owned by the Yaws, not William Arthur Pope of Arizona.

This would certainly explain the huge sums of cash this company was soon able to invest in projects like the Estrella township in Phoenix Arizona, bought from the Federal Government owned Resolution Trust Company in 1993.

After all, Samling’s vast profits have never been denied. It is just their destination which has been unknown. And it is well documented that nearly all the wealth realised from Sarawak’s timber was immediately removed abroad.

The poor native peoples of the state certainly did not benefit. The universal practice of ‘transfer pricing’, to which Taib Mahmud turned a clearly deliberate blind eye, meant that timber was sold at rock bottom prices to proxy companies, in places like Singapore, in order to avoid paying anything but a pittance in tax during all those decades of destruction.

Research further shows, and common sense indicates, that a very substantial portion of these crony companies, such as Samling, were in fact owned and controlled by the one man who had the sole power to issue and revoke all timber and plantation licences in the State, namely Taib Mahmud.

Sarawak Report has already reported that 10% of the shares in Samling Global (during the period the company was public) were registered as owned by Taib’s own cousin and frequent proxy, Hamed Sepawi, along with the Chief Minister’s private bomoh (witch doctor).

A person who was close to the former Chief Minister’s financial dealings has further confirmed to Sarawak Report that Taib “owned the bulk of the company“:

“Why wouldn’t he?” the individual responded when asked for confirmation. “He had total power, like an Emperor in Sarawak. The Yaws also made many millions, of course. “

The same source was also told in 1993 that the Chief Minister Taib Mahmud had just conducted the largest ever land purchase from the United States Federal Government.

We know from the Sunchase website which deal that was.

Taib and his proxy timber company Samling could certainly afford the purchase, given the billions illegally plundered from Sarawak. Yet it is hard to find any evidence of Mr William Pope’s billionaire status at this time.

Conflicting ownership claims

What is evident is that there is a conflicting story regarding the ownership of Sunchase compared to the one now put forward by Mr Pope.

The younger son of Samling tycoon Yaw Tech Seng, who graduated from California State University, Sacramento in 1986 with Bachelor of Science in Real Estate, Land Use Affairs and Finance, claims that to the contrary it was he who set up the company in California after leaving university.

He has detailed as much in the annual report of his new company Otto Marine, based back in the Far East.

Records in fact show that Sunchase Holdings was incorporated in California in May 1988.

The first official evidence of William Pope joining the company comes from a Securities and Exchange Commission (SEC) investigation document from 2001, which cites him joining Sunchase as its President in 1990.

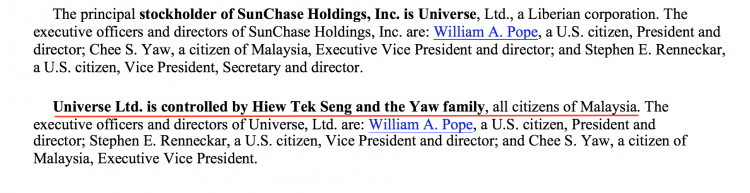

This official document is also significant in that it confirms information from the Arizona state register, which is that the 100% shareholder of Sunchase at that time – and indeed up until 2006 – was a Liberian registered company called Universe Limited.

It was therefore Universe Limited which had invested all those billions into massive land assets in the United States and indeed owned those assets until 2006.

Universe Limited, according to the SEC investigation, was owned by the Yaw family:

So, did Chee Siew Yaw really divest all of his interest in Sunchase to one of the long-term senior officers of the company in 2006?

Certainly, the company has since 2006 been registered in Arizona as 100% owned by a separate company named Sterling Pacific Assets. which was incorporated by Mr Pope in 1992. This company operated as a management company for Sunchase run by Pope, according to further documentation.

It is perhaps significant that Sarawak Report was told by insiders close to the company that Yaw decided to “high tail it” from California in 2006 as the sub-prime mortgage situation became increasingly threatening.

It leaves the question as to how Mr Pope was in a position to buy such a huge multi-billion dollar company at a market price, in order to become the 100% owner – and if he did get the backing to do so, how he could have not known of the origin of the initial finances?

Symbiotic relationship between Sunchase and the Taib family

Sarawak Report maintains that all evidence suggests that the actual and rightful owners of this massive portfolio of assets in the United States are the people of Sarawak, whose country was looted to buy them thanks to corrupted foreign practices, aided and abetted over many years by Mr Pope.

There is further compelling evidence of the symbiotic relationship between Mr Pope, Samling and their ultimate benefactor and controller Taib Mahmud right there in the Western United States.

Sarawak Report has already reported on the two multi-million dollar Seattle mansions which were originally purchased by Chee Siew Yaw in 1990 and then passed for nothing to the Taib family.

Both houses were later that year put into the ownership of subsidiary companies, owned also by Yaw, according to a sworn statement to the Seattle Kings County authorities, in order to avoid tax on the transfer.

But, by 2001, these two California registered companies (W A Boylston and W A Everitt) had been transferred into the hands of the Taib family, according to documents obtained by Sarawak Report.

We questioned such an apparent transfer of ownership without any sale being registered in Seattle or tax being paid – a matter taken up in the BMF book “Money Logging”, authored by its director Dr Lukas Straumann.

At which point Taib’s London lawyers Mishcon de Reya last year threatened to sue Struamann, because they alleged the houses:

“..were sold on, in a legal transaction at full market value, to a company controlled by members of Abdul Taib Mahmud’s family”

Research by Sarawak Report has now confirmed that this claim is totally untrue. There are several legal and official items of proof, which demonstrate that the Samling company CSY Investments (part of the Sunchase group of companies and named after Chee Siew Yaw himself) could never have legally sold on the houses to the Taibs and never paid tax if they did.

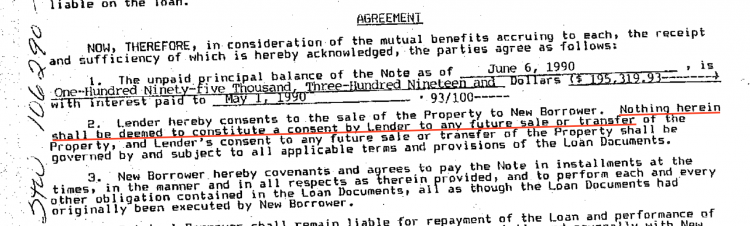

Most specifically, a charge inherited on the larger of the two mansions, 1117 Boylston Avenue East, meant that the buyer Chee Siew Yaw, was obligated to pay regular repayments to the bank right up until 2004. The terms of sale forbade Yaw from selling on the property without negotiating the matter with the bank.

There is no record whatsoever in Seattle of any such sale taking place or, in such a case, of the necessary tax being paid, between the date Yaw bought the properties in 2001 and their sale in 2009 and 2012.

There is a record, however, of the completion of the charge on the property by Yaw himself as agreed in 2004, which was several years after the companies owning the houses were officially transferred in 2001 to the Taib family company, Sakti, in California.

Indeed, as confirmed by legal experts, the clear story told by the official documents, is that these expensive homes were acquired by Yaw under the guise of the Sunchase group of companies (which were linked with his company CSY Investments both into the sale and the initial management of the properties) and were then passed on for the use of the Taib, family without a proper registered sale or the payment of any tax.

Illegally, the formal ownership was merely transferred by changing the name of the Director from Yaw to Rahman Taib in the California state registry – all without any sign of a payment of any kind (a fact confirmed by the former manager of Sakti, the deceased American citizen Ross Boyert).

Sarawak Report suggests that this symbiotic management between the Yaw family concerns and the Taib family concerns over in the United States perfectly illustrates the actual relationship between the Chief Minister of Sarawak and his biggest crony timber concessionnaire.

Whistleblower Ross Boyert claimed that Taib’s son Rahman always appeared fearful of the Sunchase Group, supposedly controlled by Samling.

Sarawak Report suggests that Rahman would never have been fearful of a client logging family, only of his father, whom we suggest was plainly the man who genuinely controlled the enormous Sunchase interests in the United States.

We believe furthermore, that there is no reason to suppose anything but that Taib is still the major controlling party behind the vast investment in property through Sunchase. The Yaw son may have “divested his interest”, but Mr Pope has taken up the role as the proxy and guardian over a vast real estate empire in America that was financed by cash stolen from the state of Sarawak.

It is time that Sarawak and Malaysia demanded these asset treasures back, so that this invested wealth can be employed to support public services in the state, which was been robbed for decades.

The fact that the present Chief Minister, Adenan Satem, has failed to take action against Taib’s plundering of the state and has come forward to support the continuing control of Samling and the five other top timber companies over the logging and plantations in Sarawak, only proves that he too is a mere proxy of Taib Mahmud, who remains the Governor and economic controller of the state.