Way back in May 2014, Sarawak Report noted that reports from Ireland and also from a British High Court judgement made clear that Najib’s 1MDB proxy, Jho Low, was using money from the development fund to back his own private equity ventures.

Specifically, in April 2011, Low had acquired a controlling debt over one of Britain’s top hotel chains, the Maybourne/Coroin Hotel Group which included Claridge’s and The Connaught, thanks to a £49.1 million sum provided by 1MDB.

Using this leverage Jho Low went on to try and buy out the whole group from its wary shareholders, who were plainly suspicious that the young businessman could seriously drum up the billion pounds plus that he was offering. According to the closely-written judgement on the matter by a British High Court Judge Jho Low was claiming that he was backed by none other than 1MDB:

“(50). The Malaysian based investor was Jho Low, a businessman with some backing from a Malaysian sovereign wealth fund. Through an entity called The Wynton Group, offers were made to the company and its shareholders in January and February 2011….

(138)…… The provision on 15 January 2011 of a letter from 1 Malaysian Berhad, an investment vehicle wholly owned by the Malaysian government, confirming its support for the offer, did not allay the concerns of the majority of the shareholders. A further letter from Wynton dated 24 January 2011 stated that the financing for the offer had “in principle” been fully underwritten by Malaysian government-backed investment funds. [Honourable Mr Justice David Richards]

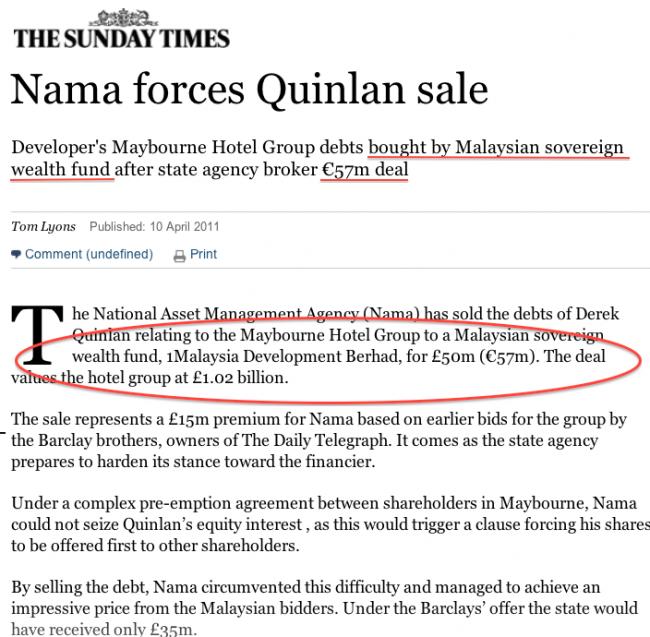

Sarawak Report at that time further cited Irish press reports that confirmed via contacts in NAMA (the official agency tasked with managing post-crisis bankruptsy issues in Ireland) that the £49.1 million/€57 million employed by Low to buy out the controlling debt in Maybourne was indeed provided by 1MDB:

That the money gained Jho Low’s private company Wynton capital control of the debt was confirmed in the High Court Judgement:

“(204). ….There was competition to purchase the debt. NAMA was approached by those acting for Wynton early in March 2011 and an offer to purchase the debt for £49.1 million was made by Wynton on 21 March 2011. The Barclay interests were not prepared to offer as much, so NAMA accepted Wynton’s offer and on 4 April 2011 executed an assignment in favour of JQ2 Limited, a company associated with Wynton and used as the vehicle for the purchase.

Yet, despite this solid evidence Low, the bosses at 1MDB and indeed the Finance Minister himself, all continued to lie throughout the rest of 2014 and 2015, by denying that Low had held any continuing relationship with 1MDB beyond May 2009, when he supposedly gave up his role as ‘Advisor’ to the fund.

Over the past year mounds more evidence have accumulated to prove how extensively they were lying.

Not only does the PetroSaudi data passed to Sarawak Report, the Sunday Times and The Edge (and now in the hands of global regulators) show how Jho Low was involved in orchestrating every move at 1MDB on behalf of the Prime Minister.

1MDB’s own Board minutes, referred to in the Public Accounts Committee’s now published report, also show that Low was attending crucial meetings of 1MDB’s Board and relaying instructions from the Prime Minister on key investment decisions via his mobile phone.

Proof of the £49.1 payment from 1MDB via Bank Negara

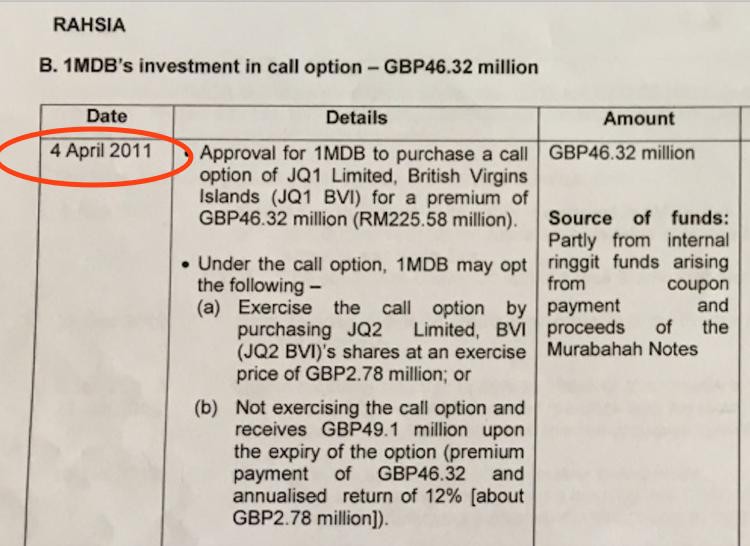

But this is not all. Sarawak Report went on to obtain documents from Bank Negara’s own enquiry in April 2011 into violations by 1MDB, which further prove that the money Jho Low used to buy out the debt option from NAMA came from 1MDB.

Our copy of a criminal investigation report by the Central Bank (which went on to fine 1MDB and demand the return of the entire US$1.83 billion linked to its initial venture with the company PetroSaudi) lists clearly that Low was forwarded the money to his company JQ2 on 4th April 2011:

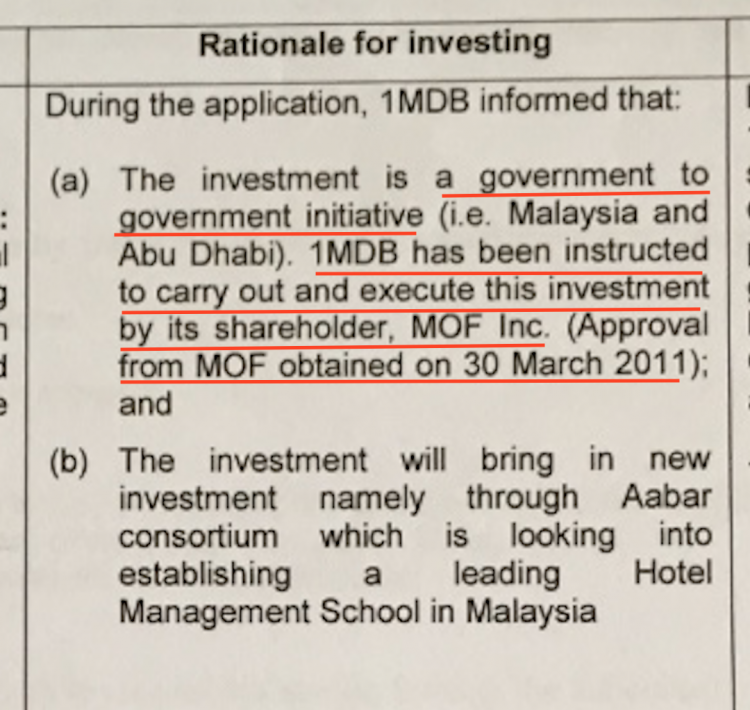

What’s more this document shows that once again this proxy to Najib Razak along with his colleagues at 1MDB brazenly lied outright when they explained to the Central Bank why they wanted the money.

According to their application 1MDB informed the bank that:

“(a) The investment is a government to government initiative (i.e. Malaysia and Abu Dhabi). 1MDB has been instructed to carry out and execute this investment by its shareholder, MOF Inc (Approval from MOF obtained 30 March 2011).

and

(b) The investment will bring in new investment namely through Aabar consortium which is looking into establishing a leading Hotel Management School in Malaysia”

Bank Negara went on to approve this application on the rationale that this injection of public money would therefore:

“Initiate business relationship for subsequent direct investment by Abu Dhbi companies into Malaysia to set up a world class hotel management school within the KLIFD and Bandar Malaysia”

In other words, Jho Low and his accomplice, the Prime Minister, had presented a staggering set of lies to the Central Bank about what was a well-recorded private bid by his private company Wynton Capital to buy out London’s top hotel group.

Once again the duo had talked loudly about a ‘government to government’ initiative (this time with Abu Dhabi) when, as with the venture with PetroSaudi, this was merely a private company venture. And, once again, the businessman and his political boss were waxing on about spurring ‘Middle East” investment into Malaysia through the deal to create jobs in KL.

There has of course been no sign of a ‘world class hotel management school’ funded by Aabar in KL. It was all rubbish and yet again the thousands of 1MDB promoted jobs boasted about by Najib never materialised.

Reference to the ‘single shareholder’ showed who was calling the shots

Particularly significant in this document also, is the early reference to the fact that 1MDB was “instructed to carry out and execute this investment” by none other than its single shareholder, the Minister of Finance Inc. i.e. the Prime Minister and Chairman of the Advisory Board, Najib Razak.

Najib denied his direct control and management of 1MDB for months and months after the initial scandal exploded last year, a fact that has now been definitively proven. Yet, even when forced to admit he was the only person able to sign off decisions and that indeed his signature was on every order, Najib last month continued to imply that he wasn’t really involved and was just signing stuff off.

What this document shows is that, to the contrary, Najib was handing out specific orders on investment decisions, based squarely on his capacity as sole shareholder and under the Section 117, which he had specifically inserted into 1MDB’s constitition to enable him to over-rule the Board.

Bank Negara was therefore informed that the Minister of Finance had instructed for this “Hotel Management School” investment to be launched by an order signed by him on March 30th 2011. No more questions.

It is therefore an unavoidable conclusion that the Prime Minister condoned a lie. He sanctioned a private bid for London’s Coroin Hotel Group, while pretending he was interested in building a Hotel Management School in Kuala Lumpur to help Malaysians develop world class skills in the hospitality field.

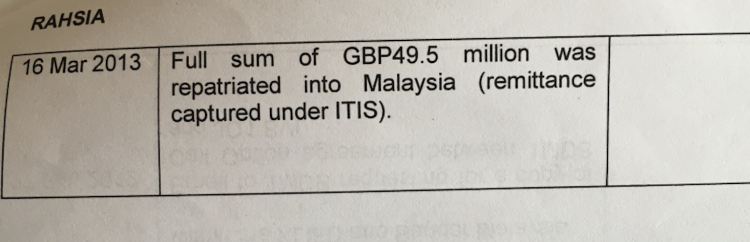

It is a small relief that when Coroin/ Maybourne shareholders decided they did not trust Jho Low and his proclaimed 1MDB backing that this relatively small sum of money was returned to Malaysia 13th March 2013.

Billions more that was misappropriated through so-called ‘government to government investments’ of this nature are still missing.

Intriguingly, the Bank Negara report makes clear the bank didn’t learn the true destination of this money funnelled through Jho Low’s companies, until it read Sarawak Report in May 2014.

Irish Independent picks up on Goldman Sachs reference letter for Jho Low

All this compelling evidence of outrageous deceit and lies is now, of course, being covered up in Malaysia, by a Prime Minister who has directed the forces of law and order to drop investigations into misappropriations involving himself.

However, the rest of the world is still unravelling the matter, including the Irish press, which has continued to follow the activities of NAMA (the National Asset Management Agency) tasked with disposing of assets belonging to Irish investors, who had got into trouble during the global financial crisis of 2008.

NAMA had sold the debt opportunity to Jho Low, who together with his new partners at the Aabar fund and the secretive backing of 1MDB, was trying to wrest control of the Coroin/Maybourne Hotel Group.

In its major update today, therefore, the Irish Independent has revealed new information, apparently from NAMA sources, which confirms that the now notorious unauthorised “letter of recommendation” for a politically connected person by Goldman Sachs, which led to the formal dismissal of its Southeast Asia Head Tim Leissner, was indeed on behalf of Jho Low and is therefore directly connected to the 1MDB affair:

The paper says that Leissner provided the recommendation so support further efforts by Jho Low to buy more distressed assets from NAMA in June 2015 (months after the 1MDB scandal had broken with the revelation of the PetroSaudi data by Sarawak Report). The paper writes:

“Tim Leissner, who had close ties to the Malaysian sovereign wealth fund 1MDB and was considered Goldman Sach’s point man in Singapore dealing with the fund, was interviewed on January 19 this year in relation to “inaccurate and unauthorised statements” made by him in a June 2015 reference letter.

According to filings with the Financial Industry Regulatory Authority, the US securities industry’s self-regulating body, the letter was written without Goldman Sach’s knowledge or approval.

Sources close to the case said Leissner’s letter had included details about the finances of his client, who is believed to be well-known Malaysian tycoon Jho Low, while overstating the extent to which Goldman Sachs had done due diligence on him.

The letter, which vouched for Low and his finances to a financial institution in Europe, was to be used to help Low reach a deal to buy real estate from the National Asset Management Agency, it is believed.

A day after Goldman Sachs quizzed Leissner over the unauthorised assurance letter, he tendered his resignation with immediate effect. It is not clear if Low progressed any deal with Nama on foot of the letter.

The London Hotel bid fell through in 2011 and documents show that Low returned the £49.1 million he had taken out of 1MDB to pursue this private venture…. or was it in fact a secret venture on behalf of 1MDB, which he claims not to have been representing?

Meanwhile, in 2012 1MDB embarked on a series of enormous bond deals together with Goldman Sachs, which raised a total of US$6.5 billion. The fact that much of that money has gone missing is the reason why Goldman Sachs is being heavily probed by the US authorities.

There can be little doubt that Leissner wrote this unauthorised and insufficiently validated letter of recommendation for Low as a favour to a key player at his top client. And he has paid the price, now that his bank is under the pressure of scrutiny by regulators.

However, the question that remains to be answered is whether this later deal being pursued once again with NAMA in 2015 was also conducted on the basis of alleged backing by 1MDB.

The details of this letter should be made public, in the interests of proper transparency in this investigation into the disappearance of huge sums of Malaysian public money.