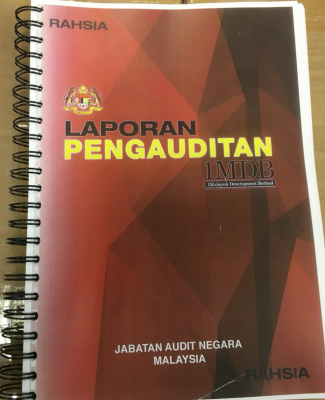

Sarawak Report has now gained extensive access to the Auditor General’s report into 1MDB, along with key accompanying documents from the enquiry.

This report was originally commissioned to shed light on the disappearance of billions of dollars, but was later declared an ‘Official Secret’ by Najib Razak.

Our review has made it abundantly clear why Najib decided that the findings could not be released, since he wishes to remain Prime Minister – after all he is also the Finance Minister and sole shareholder responsible for decision-making at 1MDB and the conclusions are damning.

What the Auditor General encountered, according to the documents, was chaos and confusion in an organisation where senior executives were unable to provide convincing or consistent explanations for vast payments made to a bogus subsidiary of Abu Dhabi’s sovereign fund Aabar and to a separate false subsidiary of an earlier venture partner, PetroSaudi.

A grand total of US$7 billion is calculated as having gone missing and conflicting and unbelievable explanations were given about why the payments were made.

The AG lamented that the justifications provided for retrospective Board ratifications of those payments (which had already been made months earlier by management without prior permission) changed from one year to the next: furthermore, multi-billion dollar payments were made for the same advertised purpose two times over.

The AG even complained that management would provide one story to his enquiry on one occasion and then completely re-write their own version of events the next time they met.

There was never sufficient proof according to his data, to back up the stories being told. In particular, bank statements were not provided to substantiate many of the simply enormous sums that 1MDB management alleged were being invested in various funds or in ‘refundable deposits’ or ‘terminations of options’ with the bogus Aabar Investments PJS Limited, based in the British Virgin Islands.

On one case the AG was plainly so incensed by the variable and inconsitent claims by 1MDB management (headed by CEO Arul Kanda), that he described their final version of events as “suspicious” and “unsubstantiated” and therefore refused to accept the documents 1MDB had provided as reliable evidence.

This matter related to a purported US$1.392 billion, that had supposedly been redeemed from 1MDB’s Cayman Island fund, and was originally recorded as having been spent on the termination of options owed to Aabar ($993 million), plus the repayment of loans.

That is what the Board was informed in December 2014 and what was recorded in the Annual Report (even though the AG records there was insufficient proof this was how the money was spent).

Then as late as February 2016, to the AG’s disbelief, he was presented with a series of papers ratified by the Board on November 26th 2015 which a year on provided an entirely separate story for how the money was used.

Based on an alleged agreement signed by management in October 6th 2014 (after most of the money had already been paid), the Board on November 26th 2015 retrospectively ratified a series of payments to Aabar Ltd totalling US$1.15 billion saying they had been for the ‘extension of guarantees’ for loans (see our previous story).

The AG complained that there had been no mention of this belated new explanation when he had previously met with 1MDB in December, although it had all been supposedly signed off the previous month:

a. Although this resolution was approved on Nov 26, 2015 it was only presented to the JAN [AG enquiry] on Feb 2016. This important information was not raised during (JAN’s) discussions with 1MDB’s management held on Dec 16, 2015. This raises doubts on the veracity of the information and documents which were presented.

b. This also showed that the 1MDB management had made payments without prior knowledge or approval from the Board. The information is also in conflict with information that was given by the 1MDB management during the Board meeting on Dec 20, 2014 – that USD1.392 billion from the redeeming of SPC funds had been used to pay for Aabar’s Termination of Options amounting to USD993 million and the USD399 million used for interest payments for the USD Note(s). However, JAN was unable to verify both payments. [Addendum Document to AG’s Report]

It gets worse, thundered the AG in his addendum to his report, explaining why he had rejected the belated material from his enquiry, on the grounds that it was simply too suspicous:

Although the agreement was signed on Oct 6, 2014, the document was only presented to JAN on Feb 2016 and this important information was not acknowledged or raised during meetings with 1MDB’s management on Dec 16, 2015. This raises doubts on the veracity of the information and documents that were presented.

4. Remittance Slip regarding payments to Aabar and Aabar Ltd

There are 9 remittance slips regarding payments to Aabar (1) and to Aabar Limited (8) which were presented to JAN on Feb 2016. This important information was not acknowledged or raised during meetings with 1MDB’s management on Dec 16, 2015. The veracity of the format of documents was suspicious as it does not include written instructions to the bank nor bank statements as supporting documents.[Addendum Document to AG’s Report]

Double payment meant 1MDB bought out Aabar’s ‘options’ for more than its guaranteed power plants were even worth!

The AG continues by saying that according to the original data provided by 1MDB the ‘options to Aabar’ were terminated twice over with near identical payments totalling over US$1.8 billion – more than the total value of the 49% of the company Aabar was supposed to be guaranteeing.

Indeed it seems clear that the decision to alter the reason given for these payments was only taken after this outrageous double payment had been spotted and reported upon in the press over a year later. The AG wasn’t buying it:

5. Funds from the Duetsche Bank loan (USD250 mil and USD975 mil), a total of USD855 mil was used for Aabar’s termination of option from May to Sept 2014. According to the Board’s minutes on Dec 20, 2014, a total of USD993 mil was also paid between Sept and Dec 2014. This means that the total amount paid for the termination of option was USD1.848 billion. The total termination of options payment amounting to USD855 million was only changed to Top Up Collateral (Security Deposit) a year later through the Ratification of IPO Variation Payment Made to IPIC on Nov 26, 2015. This demonstrated that the original intention of 1MDB was to pay a total of USD1.848 billion to Aabar Ltd, in contrast with the total stated in the Agreement Relating to Option Agreement (Settlement Agreement) amounting to USD300 mil (refer to Chapter 5, para 7.3.3.4. Pg 189). [Addendum Document to AG’s Report]

Apart from this, the USD1.848 billion amount exceeded the 49% equity value in 1MDB Energy Sdn Bhd (1MESB), which amounts to RM1.225 billion, and RM862.40 million in 1MDB Energy Langat Sdn Bhd (1MELSB) which amounts to RM2.09 billion in total (refer to Chap 5, para 7.3.2. Pg 182).

Slack?

That a government fund could be run in such a negligent fashion, with such an apparent slip-shod attitude towards the dispensing of billions of dollars of public money, would under normal circumstances defy belief.

Scanning through the AG’s forensic analysis, readers are consequently led to one glaring conclusion, which is that no one, from 1MDB’s management to the Board, considered it to be their job to worry about the genuine custody and investment of all this cash. In other words, the fund was plainly a front behind which money was being siphoned out by the man in charge (the sole shareholder/Finance Minister/Prime Minister).

No one could conclude otherwise from the narrative and criticism laid out in the AG’s 300 page plus report and analysis, as we shall show over coming articles.

No wonder the Prime Minister, who had a year before assured Malaysians that their concerns would be put to rest about the loss-making fund through this audit, has decided to make it a secret instead.

Changing Options

This was how the Auditor General in the main body of his report referred to how the Board was informed about the supposed second payment of options to Aabar, made from money lent by Deutsche Bank, based on a promise that there was a collateral cash holding of a billion dollars in BSI Bank Singapore (untrue).

“8.9 The Board of Directors [of 1MDB] were informed on Dec 20, 2014 that Deutsche Bank AG, Singapore had agreed that the USD993 million be used to pay for Aabar’s termination of options from redeeming the SPC funds amounting to USD1.392 billion. Tthe balance of USD399 million were to be used to pay interest off loans in USD Notes.

8.10 However, details about the payment of USD993 million to Aabar for the termination of options and the interest payments on the USD Notes amounting to USD399 could not be verified by JAN. The Board of Directors had also sought details on the payments on Dec 20, 2014, but checks by JAN have established that the matter was not raised again during subsequent Board of Directors meetings. During their meeting on Feb 23, 2015, the Board of Directors had raised the issue of payments for Aabar’s termination of options, and that they were informed only after the payment was made. This showed that the payment for Aabar’s termination of options was made without the Board of Director’s approval.”

In other words, neither the Auditor nor the Board of Directors were ever able to get any proof out of 1MDB management that the money had existed in the first place or had been utilised in the manner being claimed! A pattern of activity, whereby the Board failed to be consulted by management and was just expected to sign off vast payments retrospectively, is confirmed time and again in this report.

Bogus Guarantees

The AG also deals with the whole frustrating story of the supposed ‘security deposits for guarantees’, which we now also know were in fact never part of the formal agreements with Aabar/IPIC when the Abu Dhabi fund agreed to guarantee the US$3.5 billion raised in two ‘power purchase’ loans in May and October 2012.

He confirms that nevertheless a total of US$1.367 billion was paid in the name of such guarantees to the bogus Aabar Limited in BVI:

Chap 5 – Energy Sector.

Item 7 “Funding for 1MDB Group’s Energy Sector”

7.3.2.2. Collaboration Agreement for Credit Enhancement7.3.2.2. (f) Checks by JAN [AG Department] found that the security deposit amounting to USD1.367 billion (RM4.468 billion) was paid by 1MEL (1MDB Energy Ltd) and 1MELL (1MDB Energy [Langat] Ltd) to Aabar Ltd and was recorded as a security deposit in the financial statements of 1MEHL (1MDB Energy Holdings Ltd) for the year ending May 31 2013 and 2014. However, the security deposit payments were made without the approval of the Board of Directors. The responsibility of payment for the security deposit for the issuance of the first USD Notes was transferred to 1MEHL because 1MEHL had acquired 1MEL from 1MDB. This is based on the Assumption for Obligations Agreement dated Nov 1, 2012 between 1MEHL and 1MEL. Details are as follows:

Table 5.27 – Security Deposit Payments to Aabar Ltd [pg 184]

Date Payee Total USD mil Total RM mil 22/05/2012 1MEL 576.94 1,885.73 19/10/2012 1MELL 790.35 2,583.63 TOTAL 1,367.29 4,468.99 Source: Agreement and Deloitte papers

Note: BNM exchange rates = May 2012 (RM3.18) and Oct 2012 (RM3.06)

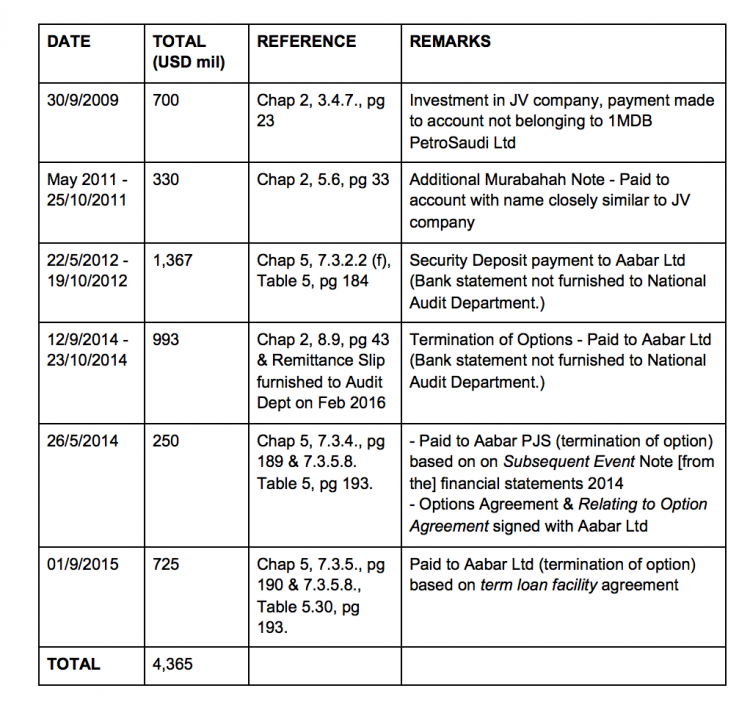

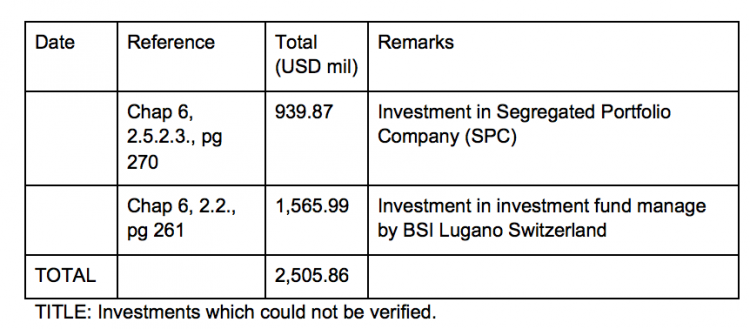

Total of US$7 billion missing!

The above dodgy payment, it should be noted, joins a number of others which the AG said 1MDB failed to substantiate with any concrete evidence such as bank statements.

Accompanying the report is a chart produced by the AG’s department detailing the unsatisfactory and unproven payments identified by his enquiry, with total up to the US$7 billion, which the AG concludes has effectively gone missing from 1MDB:

INVESTMENTS WHICH COULD NOT BE VERIFIED

[GRAND TOTAL $6.87 bn]

The culpability and deliberate deceit behind all this mismanagement is summed up by the Auditor in his addendum document about the bogus ‘Top-Up Security Deposit’. His final paragraph states that the then CEO and present Board Member Shahrol Halmi, knew perfectly well there were no payments owing to Aabar for its guarantees on the loan. This was because the AG had a copy of the original agreement signed between Halmi and IPIC/Aabar in May 2012. IPIC was happy to rely on the promise of a Malaysian Ministry of Finance obligation to 1MDB (ie the taxpayer was liable).

IPIC and 1MDB had signed another agreement known as Interguarantor Agreement on May 21, 2012. This agreement was signed by Shahrol Azral on behalf of 1MDB and Khadem Al-Qubaisy for IPIC. Checks by JAN showed that the agreement did not state a need for 1MDB or its subsidiaries to issue USD Notes to implement the “option and credit enhancement” to Aabar Ltd in return for a guarantee from IPIC. (emphasis theirs).

According to the main condition of this agreement, 1MDB must continue to be wholly owned by MKD (Finance Ministry Inc). 1MDB also needs to receive sufficient support and funds from MKD to repay IPIC, should 1MDB fail to repay all the cost, expenditure and all obligations regarding this note [USD Notes?]. Although a guarantee was given by IPIC, 1MDB still bears all the risks should there be any failure to pay for all the cost regarding the servicing of the USD Note.

Following the AG’s report and parallel Public Accounts Committee report the Inspector General of Police publicly notified that he would be investigating this former CEO and Board Member of 1MDB over suspected criminal behaviour.

However, a month later and no such moves have been made, although numerous critics of 1MDB (all vindicated) have been harassed, persecuted and charged on apparently trumped up charges.

Halmi, on the other hand, has let it be known that he considers himself protected by the power of the Prime Minister/Finance Minister and the kind and gracious support which he is receiving from his wife, Rosmah Mansor.

SR wishes readers a Happy Eid with hopes for better things to come.

More on the details of the AG report later this week.