Long term Taib flunky Idris Buang has taken to the pages of the GPS funded Dayak Daily to complain that it is unfair to describe what has happened at the ASSAR fund as being Sarawak’s equivalent of 1MDB.

Some RM500 million belonging to around 72,000 Native Customary Landowners in supposed ‘compensation’ for the forced alienation of their lands was placed into the fund and now there is none left.

Idris is a non-executive director of ASSAR, amongst the very many posts he has held propping up the Taib family’s control of Sarawak, and he berated opposition assemblyman Dr Ting Tiong Choon saying Ting should retract the likeness with 1MDB, which was first raised by Sarawak Report back in 2016 when we revealed that the value of the fund had by then plummeted to just 17 cents in the ringgit:

“As far as I know, all the legal parameters are met. So, there is no such thing as (Assar being the same as) 1MDB and to create a perception of corruption. He should have checked his facts, verified them with the external accountant of Assar, the Securities Commission etc on whether there is anything amiss…”

Two years on, as Ting Tiong Choon has pointed out, the value of ASSAR has continued on down to a nominal 2.9 cents to the ringgit last December. That is a simple figure with which to answer Board Member Idris’s challenge as to whether anything is amiss.

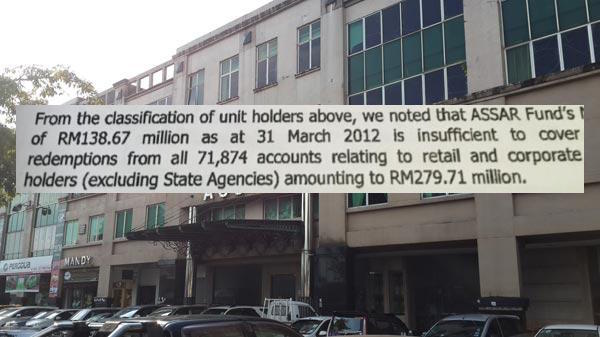

Sarawak Report produced an extensive article on ASSAR two years back, based on evidence that included a devastating report from the very Securities Commission that Idris Buang (who appears to be a dopey director at best) has alluded to. The vast majority of investments by the fund had failed and there was no proper due dilligence and compliance in place to ensure there was no conflict of interest in investments by the fund into crony companies.

So, here are some headlines from back in 2016: 82 of its 90 chosen investments (‘counters’) lost money; there has been no consistent dividend or reporting made available to the forced investors in the fund (the NCR owners whom Taib claimed were being introduced to the ‘shareholder economy’); people seeking to remove their investments after the mandatory 5 year period have encountered grotesque delays; the state government has paid in a hundred million to relieve the situation, but it hasn’t worked.

Interestingly, until HSBC pulled out of Sarawak in early 2014 it acted as the trustee supposedly in charge of supervising the managment of the fund. The bank was at the same time managing several Taib family accounts and also lending to Taib family connected logging and plantation companies.

So, might one ask, if ASSAR is the 1MDB of Sarawak, was HSBC the Goldman Sachs?

Please read our original story and feel free to answer Idris Buang’s comments complaining about criticism of ASSAR’s management.

Also, feel free to respond to Taib’s former political secretary Karim Hamza is back also this week complaining that ‘people are fed up‘ with the new Malaysian government for not fulfilling promises that his own party opposed at the time of the last election – eg higher oil revenues for Sarawak.

The same Karim Hamza created waves on Radio Free Sarawak when he pronounced that politicians like Taib and his family ought to be able to ‘make some business’ whilst in office, because why should tycoons live richly and not elected politicians?

And Idris Buang says there is no evidence of anything amiss?