Open Letter Re-Lynas Malaysia

Copied: Australian Federal Police

Dear Andrew Arnold,

I am contacting you as an observer of Malaysian affairs to ask for your advice regarding widespread bewilderment over a highly controversial contract recently completed by your company, Lynas Corporation, in the State of Pahang. I have a number of questions I would be grateful if you could answer.

Lynas is quoted on the Australian stock exchange but has become notorious for various activities connected to your subsidiary, Lynas Malaysia, and its co-called Advanced Material Plant for processing rare metal (mined from Mt Weld in Western Australia).

The process involves the use of very concentrated acids at very high temperatures and produces two forms of hazardous waste, one of which is a low level radioactive by-product.

Rules in Australia demanded you procure a permanent disposal site that would contain the radio active wastes for 10,000 years, so it would seem you sought out a less demanding regulatory environment, preferring to transport all your tons of rare earth by sea to a factory built on 100 hectares of formerly protected mangrove forest off the coast of Kuantan, which you have turned into a toxic zone.

Do set me right if I am wrong about any of the above, but that does seem to be the agreed version of the facts, certainly in the minds of most Malaysians.

Moving on to the specific contract that I wanted to ask you about, namely the award announced in February 2020 of a hundred million dollars to a Malaysian company called Gading Senggara Sdn Bhd (“GSSB”) to construct and manage what you describe as a Permanent Disposal Facility (PDF), which had just been granted approval by the Pahang State Government.

The contract places the entire process for disposing your toxic by-products with a company that your press release comfortingly describes as part of “a major Malaysian business conglomerate” and also “a government-appointed concessionaire licensed to dispose of industrial waste for the east coast region of the Malaysian Peninsula.”

Lynas Malaysia has contracted Gading Senggara Sdn Bhd (“GSSB”) to manage the entire PDF project, including planning, construction, operation and institutional control during the post-completion period for a period to be determined by the regulatory authorities.

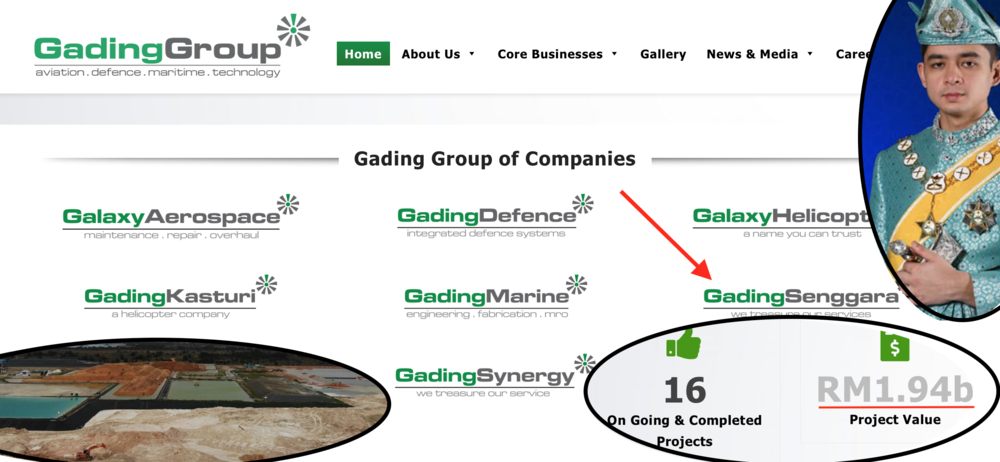

GSSB is a member of the Gading Group of Companies and the group is a major Malaysian business conglomerate whose businesses include Aerospace, Defense, Maritime, Development & Construction, Energy & Raw Materials & Trade, and Oil & Gas. GSSB is also a government-appointed concessionaire licensed to dispose of industrial waste for the east coast region of the Malaysian Peninsula. [Lynas announcement Feb 2020]

My first question, therefore, given the wording of the announcement, is did Lynas appoint the contractor following an appropriate tendering exercise or did the Pahang State Government appoint the concessionaire as a condition for allowing you to create the dump?

Regarding other contracts to the Gading Group (of which more later) we note they boast of winning tenders, but not this one. Likewise, your quarterly reports make no mention of tendering for this hundred million dollar contract as it does with tenders elsewhere. So, would you be so good as to publish evidence the job was appropriately tendered?

After all, Australia’s Aid Watch has just initiated a petition suggesting it was not and that the chosen company is not suitable for the highly specialised and sensitive job in hand:

“There was no public tender to select the most appropriate company with the necessary experience, track record and qualifications to undertake the PDF project. Instead, a newly formed company with strong political connections and influence, with no prior experience in radiation safety and protection or toxic waste management has been awarded the construction contract.”

Do you reject this claim?

By way of a little more explanatory background (as this in an open letter) the construction of this Permanent Disposal Facility was forced on your company during the brief tenure of the PH government (elected after UMNO was turfed out of office in 2018) which conducted a review of Lynas’s waste disposal record following years of concern and protest about the factory in Malaysia.

Voters had hoped that PH would close the plant down entirely. However, the interim prime minister, Dr Mahathir, came to a compromise instead, after discussing the matter on an official visit to Japan of all places.

The compromise was that Lynas would remove the smouldering red, ‘low level’ radioactive heaps of waste that had been mounting outside the Kuantan factory ever since operations began in 2012, to a site suitable for disposing of potentially hazardous material somewhere in Malaysia.

Meanwhile, your company would make further arrangements to ensure that no more toxic materials would be transported to Malaysia beyond 2023.

In line with that agreement you apparently began looking for alternative toxic dump sites back home in Australia and promised an announcement by the end of 2019. However, it appears the locals have also protested in your chosen Kalgoorlie Boulder area and two years later, at the close of 2021, you remain stalled on that commitment?

Is the pressure now off on the Malaysian side with the return of UMNO who granted the concession in the first place?

My further understanding is that the Japanese intervention may not have been entirely unconnected to a massive loan that has been extended by a Japanese state funding arm to support your operations – a loan that has turned distinctly soft, after several renegotiations, and now amounts to some $145 million outstanding. Have you any comment on this matter?

The materials you produce are, of course, vital for the manufacture of many of Japan’s electronic goods and can only otherwise be accessed from China. One wonders why the Japanese Government has not considered the alternative solution of locating this plant of yours on their own territory instead. Perhaps you can suggest the reason?

Australia’s Bribery of Foreign Public Officials Act

Back to my core concerns regarding the contract to Gading Senggara Sdn Bhd (GSSB), which would appear on the surface of things to potentially violate your own Australian Criminal Code and its various amendments relating to the Bribery of Foreign Public Officials.

Exemptions offered for minor facilitations under Section 70.4 of the Act specifically do not include any decision about whether to award new business or whether to continue an existing business, which this hundred million Permanent Disposal Facility would appear to be.

Can you argue otherwise or perhaps that the owners of Gading Senggara Sdn Bhd can not be categorised as foreign decision makers or influencers or their relatives in the sense laid out in the Act?

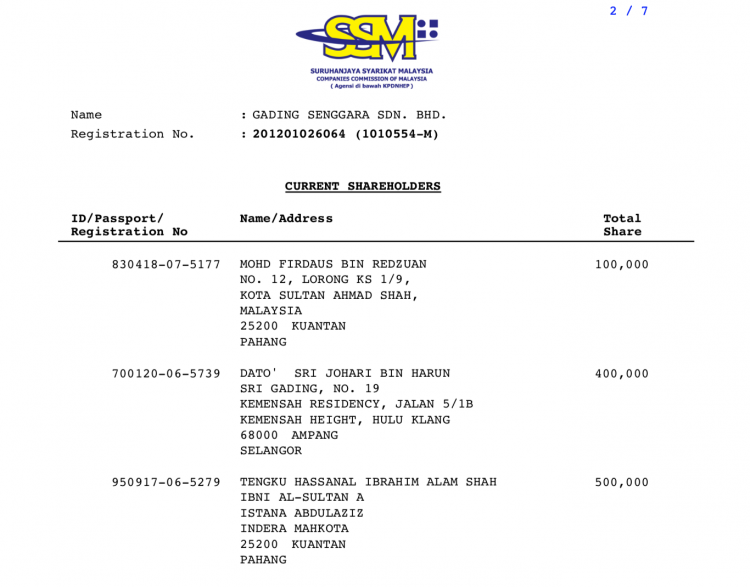

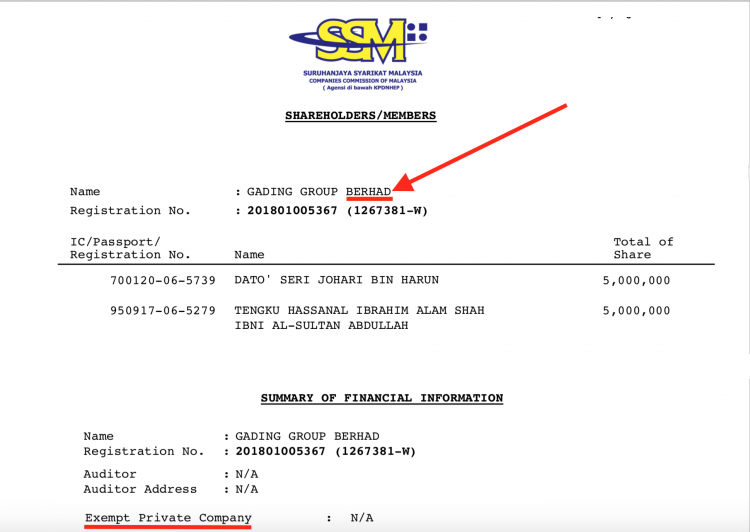

After all, it didn’t take long for campaigners and journalists to look up the ownership of GSSB only to discover that the two major shareholders were Johari Harun, who is a senior UMNO official in Pahang (the party that dominates the State Government which granted the licence) and Tengku Hassanal Ibrahim Alam Shah, the Pahang Prince Regent i.e. the eldest son of Pahang Sultan who in January 2020 had just been appointed King of Malaysia.

The Prince Regent himself is therefore the acting head of state in Pahang, employed by the public with an official salary.

Would such immensely powerful players as these in their home state not come under the category of foreign officials under the terms and spirit of the act in your view? The son is acting as the Regent in the state whilst his father serves as King and he receives an official allowance in his capacity as head of state which is paid for by the public.

So, it would be great to hear your position on the matter which has really riled folk in Malaysia who are unfortunately very used to seeing such contracts handed to royalty and ruling party insiders associated with the granting of licences such as yours.

Indeed, the Australian Federal Police fact sheet on the bribery of foreign officials suggests that one of the many indicators of the practice is “contracts being won without tender” where the purpose of such a benefit is “intended to influence a foreign public official in the exercise of their official duties for the purpose of obtaining or retaining business or a business advantage”.

Perhaps you can provide some convincing arguments for the Malaysian public to assure them that the award to this ‘crony company’ (as Malaysians would term GSSB) in no way constitutes the sort of ‘bribe’ that the Act was set up to prevent, on the grounds that “Bribery distorts markets, artificially inflates prices, undermines democracy and leads to sub-standard products being procured” (to further quote the fact sheet).

AUD$300 Million Potential Fine?

The potential penalties for Lynas in the event that it were to be found to have bribed its way into Malaysia, according to the fact sheet, are severe: “Corporate entities face a fine up to AUD17million or three times the value benefit gained from the bribe, whichever is greater [$300 million in this case?]”. Plus there is a potential ten year prison sentence for guilty individuals from the company.

This is why I am troubling to send a copy of this letter to the Australian Federal Police who are designated as the investigative body on such matters. You never know, regulators and enforcers occasionally do their jobs, even to investigate big boys like yourself.

Best Outfit For The Job?

One assumes a key part of Lynas’s defence would be the suitability of GSSB for the specified task in hand. However, so far, you will know that their suggestions for proposed dump sites have gone down like buckets of sick.

The first idea floated in March was for yet another area of Pahang’s remaining protected forest to be de-gazetted by the obliging UMNO dominated State Government, so that it could be razed of timber and then play host to the radioactive waste. After it was pointed out that this environmental tragedy would also endanger ground water sources and local rivers that plan eventually collapsed.

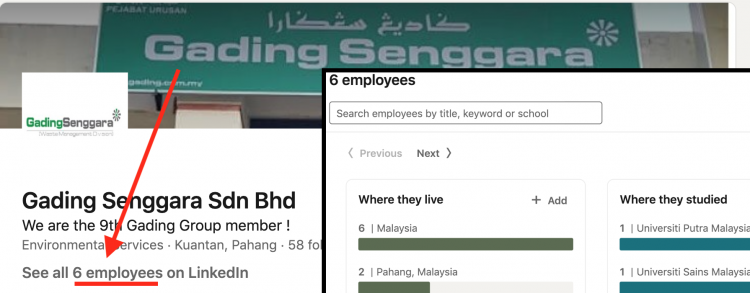

Do the six cited employees of GSSB not include any with a basic education in geography or science one is left to wonder?

The updated proposal issued in October is to dump the sludge into a peatland area, which protestors claim is the worst possible type of unstable location, suppurating in tropical heat and again linked to the local water table.

Nevertheless, your company Lynas has promoted GSSB in its announcements describing it as part of an impressive Gading Group of companies “a major Malaysian business conglomerate whose businesses include Aerospace, Defense, Maritime, Development & Construction, Energy & Raw Materials & Trade, and Oil & Gas”.

Would you stand by that description as wholly accurate or as being somewhat misleading?

Let’s look at GSSB itself to start with, since its depictions as an experienced big player in the field of toxic waste disposal has already been ripped into by campaigners and anti-corruption bodies such as Malaysia’s C4.

The Gading Group website claims the company has “established itself as a formidable player in the waste management sector in Malaysia” since being incorporated in 2012, having “successfully undertaken numerous projects for our clients from both the private and as well as the public sector.”

It continues “GSSB was appointed by the Pahang State Secretary in 2019 to develop and provide landfill services and municipal domestic waste management in Kuantan”.

However, this single cited contract appears to relate to just one landfill site for municipal waste which was apparently enhanced by an approval by the Environment Agency to “handle scheduled waste from industrial activities”.

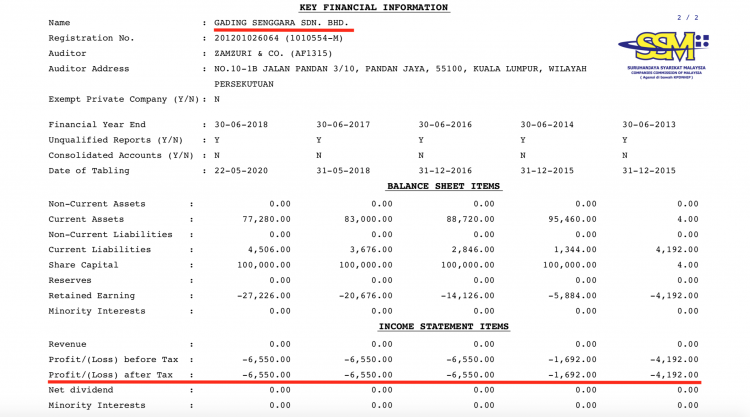

Moreover, a scan of the company’s own financial record makes clear that from its incorporation in 2012 until the Pahang State contract was awarded in 2019 (to be followed by the Lynas $100 million contract) there was virtually no financial activity to indicate the thriving profile that has been projected for this company.

The income statement registered by the ROC indicates a profit/loss flow of at best around RM6,000 in each of those years, too low even for tax to be applied, with a share capital of just RM100k (US$20k).

It is a surprising financial profile for a company about to be awarded a $100 million to undertake a highly sensitive radioactive earth disposal project. So how much due diligence did Lynas do on that – have you some corporate papers you could share?

Troubling Indicators Around The Gading Group?

In the course of that due diligence, for example, did you take a glance at the Gading Group Facebook page, for the touted umbrella company of which GSSB is termed as being one of several components?

Far from posting the multiple activities of a vibrant waste disposal company or indeed the activities any of the other Gadang subsidiaries, the page has concentrated on numerous fawning pictures and messages of good will to the previous Prince Regent of Pahang (who became Sultan in May 2019 and Agong of Malaysia in January 2020) as well as his son the present Prince Regent who is the majority owner of the GSSB.

Apart from this and various homilies such as “What Comes Easy Won’t Last” (except for Malaysian royalty?) and a couple of job advertisements there is no reference to an active company completing contracts whatsoever.

Moreover, did it not concern you back at Lynas corporate headquarters when in early 2021, after the GSSB contract got out into the open and the media reported that the owners of the ghostly contractor revealed, these valuable assets worth nearly a million ringgit started to be tossed around officials of the company like hot potatoes?

Just before your contract, in May 2019, the company became equally owned by a director named Mohd Firdaus bin Redzuan and the Prince Regent, Tengku Hassanal Ibrahim Alam Shah.

Then, in August 2020, Firdaus transferred 400 of his 500 shares to the proclaimed CEO of the Gading Group Harun Johari, who is also Vice-Chairman of UMNO in Bentong, Pahang. At this point there were three shareholders.

Next came the publicity following the Environmental Impact Assessment into the Pahang forest proposal and all hell broke loose. First, in January 2021, the Prince Regent transferred all his 500 thousand shares to Johari. Then in early February 2021 Johari transferred all 900 thousand of those shares on to a second director called Ahmad Radzi bin Zaini. Finally, on 21st February, Radzi returned the 900 thousand shares back to Johari and the Prince Regent in the same proportion as before.

Can you explain this rather guilty looking behaviour resembling a cover-up and can you confirm whether money actually changed hands in these transactions, given that at the very least shareholders back in Australia must be interested in the handling of your million dollar contract?

Gading Group of Companies

If Gading Senggara has turned out to be rather insubstantial and its conduct most unusual, what of its relationship to the greater Gading Group of companies, since the Lynas announcements give a clear impression that GSSB is part of an established “major Malaysian business conglomerate” with an impressive slate of technical, construction and engineering capabilities?

Did Lynas look beyond the singing and dancing Gading Group Berhad website and its empty Facebook page to question why no board members or executive officers are publicly named, for example, and no history of the group is laid out either?

ROC information confirms that the directors of the seven companies, which claim to have earned a whopping RM1.8 billion (AUD$600 million) out of a total of 16 on-going and completed projects, are from the same team lead by Johari Harun, including Redzuan and Radzi.

However, as the latest addition to the group, Gading Senggara appears to have a separate status in that it claims to be “a subsidiary company of Gading Group Berhad (GGB)”, whereas the others are separately owned either by Johari bin Harun or his fellow group of connected directors.

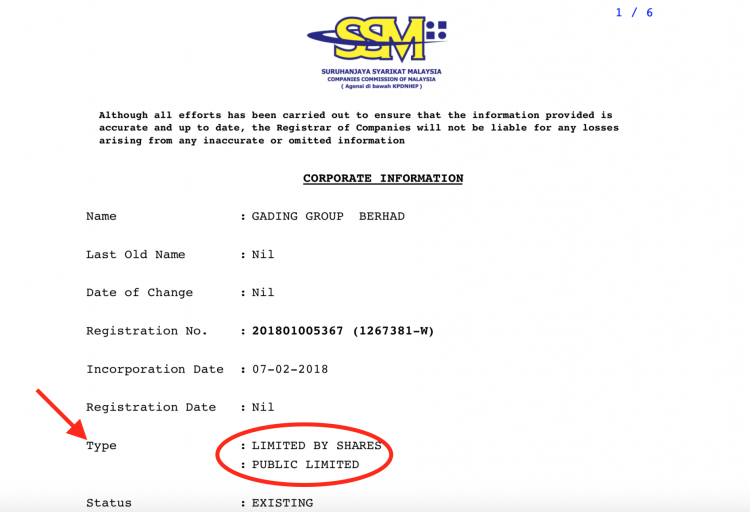

Gading Group Berhad appears to have an unusual status. The name Gading Group Berhad (GGB) indicates that this is a public listed company in Malaysia and indeed this is how it is categorised.

However, there is no board of directors and when it comes to declaring its accounts GGB claims exemption on the grounds it is a private company within the very same submission to the Registrar of Companies.

Whilst conducting your due diligence did you resolve this contradiction and if so can you explain it, given that it is a legal requirement that a private company in Malaysia be named Sendiran Berhad (Sdn Bhd) and not Berhad (Bhd)?

After all, the misuse of titles (should such be the case) ranks as a very serious matter back in Australia and would constitute a breach of the Corporations Act 2001, incurring penalties from the ASIC.

What is revealed from the limited filings for this ‘public limited company’ is that Gading Group Berhad (GGB) was incorporated only in February 2018, after the Prince Regent became a Director and Shareholder of the ‘subsidiary’ GSSB end of June 2017 (he resigned as a Director July 2019). Therefore, GSSB is not actually a subsidiary of GGB, it merely shares shareholders and directors.

Currently GGB registers ten million ringgit worth of shares, which are also revealed as half owned by the Prince Regent and half by the Bentong UMNO vice-president Harun Johari (which would seem too great an asset to allow for the new exemption clauses brought in by UMNO). Was this the capital base that gave Lynas comfort over the $100 million contract for which you have lodged a deposit of $50 million up front with Malaysia’s Atomic Energy Licensing Board?

If so, there really can be no denying can there that, whoever was registered as the shareholder or director of GSSB at the time you considered their bid, Lynas must have known that the ultimate owners of the subsidiary were the politically exposed Prince and the UMNO man?

Concerns arising from this connection include all sorts of conflicts of interest in Malaysia surely? Not least, whether the business interests of the Pahang royal family might be represented as having potentially affected the judgement of the King when he intervened, not once but twice, to appoint prime ministers not from the majority PH coalition that won the last election but first a defector without parliamentary supporters and then an UMNO man?

After all, UMNO politicians welcomed Lynas into Malaysia at federal level (when the Pahang MP, Najib Razak, was PM) and at state level in Pahang (with no requirements on waste disposal) and then allowed a licence for the Prince’s company to undertake the $100 million disposal contract. PH, on the other hand, pandered to public interest considerations.

Gading Group – A Royal Connection To Military Procurement?

Following the discovery that your due diligence teams must have made about the royal connections of the Gading Group we do wonder if, like Sarawak Report, you started to dig deeper, for reputational reasons if nothing else? It makes for a sobering insight doesn’t it?

The interest of the present Sandhurst-educated Agong (as was his son the Regent) in military matters is of course no secret. It was recently reported that he took time out of his prolonged autumn break in the UK to meet with none other than the UK Chief of Defence Staff.

However, for a disinterested head of state, any link to defence procurement makes for dangerous territory, particularly given this royal family’s close local association with the convicted kleptocrat and former Defence Minister, Najib Razak, (a Pahang UMNO MP).

Naib was notoriously found out for skimming over a hundred million ringgit from deals such as the three French Scorpene submarines manufactured by the group Thales, a scandal that escalated into the murder of young translator who was threatening to blow the story at the hands of Najib’s bodyguards.

Nonetheless, proud announcements issued in March on the Gading Group Facebook site for its company Gading Marine indicates that the now royally connect outfit has successfully ‘built and delivered’ no less than six Fast Interceptor Crafts for the Royal Malaysian Navy, following a contract won just six months previously and worth an impressive RM80 million.

The boats were apparently built at the Gading Marine yard in Lumut Port Industrial Park, Perak:

“Faced with a daunting task of building and delivering 6 boats in the space of 6 months, once again Gading Marine rose to the challenge and completed the project successfully”, the promotional boasts.

A second contract referred to by the Gading Group website relates to another recent rapid delivery of two speedboats to the Royal Malaysian Police in May 2019. The value of the contract was reported as being RM28.2 million according to a statement by Police commander SAC Mohd Yusof Mamat.

In terms of opportunity however, the projects appear to be only an hors d’oeuvre for the now royally connected provider, given the remarks of the then Defence Minister and now UMNO Prime Minister Ismail Sabri at the handing over ceremony for the naval patrol boats back in March:

Commenting further, Ismail Sabri said, his party will add another 13 ships of the same type to further strengthen the control of the country’s waters.

“The acceptance of the six ships is the first stage and we plan to add another 13 similar ships worth more than RM120 million,” he said. [translated]

It is a pattern that appears to repeat itself with regard to another Gading subsidiary, Gading Kasturi, which boasts of its provision of six helicopter flight simulators to the Malaysian airforce, which appear to have actually been manufactured by Thales in 2016 according to a Thales press release:

“Thales was selected to deliver an FNPT II (Flight and Navigation Procedures Trainer) simulator to the Royal Malaysian Air Force for the purposes of initial pilot training. The simulator, delivered to the company Gading Kasturi, has been in operation since December [2016] .

According to coverage at the time the value of the contract was yet again RM120 million:

The RM120 million deal was awarded to Gading Kasturi Sdn Bhd, a little known aviation company. According to the company’s website, Gading Kasturi is a joint venture cooperation between Gading Sari Holdings Sdn Bhd and Mycopter Aviation Services Sdn Bhd. [Malaysia Defence]

There is a promise of further lucrative collaboration with Gading Kasturi somewhat as the middle-man, according to Thales which reported:

This first collaboration between Thales and Gading Kasturi signals the beginning of a strong partnership in the field of flight simulation and reinforces Thales’ positioning in the domain.

Given Thales Scorpene background and Najib’s close association with the Pahang royal family as their key local MP it all rings rather uncomfortably doesn’t it. Or maybe you don’t think so?

Military Contracts Falling Out Of The Woodwork?

The more we look into the Gading Group collection of companies and their RM1.8 billion worth of contracts the more military contracts come to light, several of the less recent ones having been signed during the prime ministership of the Pahang MP and convicted kleptocrat Najib Razak.

Related companies, Galaxy Helicopters and Galaxy Aerospace (also in the Gadang Group) would appear to be primed to receive new opportunities – viz this Linked In profile”

Galaxy Aerospace (M) Sdn Bhd (GAM) establishes [sic] in 2015 as a new player in the growing Malaysia’s aviation market. GAM strive [sic] to be a well-known private aviation company providing Maintenance, Repair & Overhaul (MRO) services, Technical Consultancy, Parts Sales, Aviation Design and also After Sales Support thru [sic] our partnership with various major OEM. Despite our very young establishment, our team represent [sic] a cumulative of 35 years of experiences and knowledge in the Malaysian Aviation Industries including Government, Private and General Aviation sector. [sic]

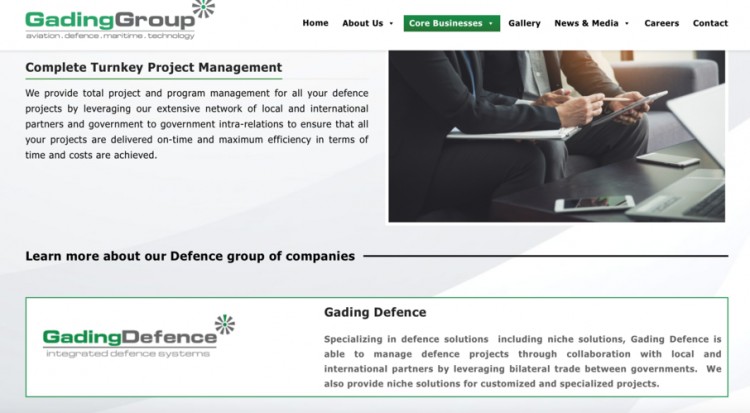

Perhaps it is the Gading Defence subsidiary that provides the clearest explanation of the role this group of companies is best able to perform in Malaysia.

There are no specific projects mentioned, however the website page explains the ‘turnkey’ role the company claims that it is able to perform by “leveraging our extensive network” of partners and ‘government to government intra-relations’ to get things done.

All in all, the Gading Group presents the unmistakable appearance of a company connected to royalty in Malaysia which positions itself between companies like yours and big contract opportunities in order to make a very handsome profit out of government contracts and licenced projects.

Did this not raise the same alarm bells with yourselves at Lynas as it does with everybody else who has examined your waste disposal contract with the Gading Group?

We therefore hope to receive your full responses on whether you consider Lynas vulnerable under Australia’s own foreign bribery laws and if not why not?

Should you be moved (as is your reputation) to launch an instant flurry of legal action about this open letter, which is based solely on publicly available information with regard to a matter of evident public interest, we would further like to extend our commitment to provide this same platform for Lynas to publish its full comment and any rebuttals it might chose to make in the form of an exclusive unedited article based on your reply.

We hope you think that’s fair given the gravity of these matters for the citizens of Malaysia?

Kind regards

Editor