Foreign Secretary, James Cleverly, drew the short straw as last weekend’s TV spokesman for the Conservatives, resulting in a series of car crash interviews as he attempted to defend his former PM – discovered to have proffered top public jobs to donors who sorted his cash flow crises – and also the short-lived chancellor and present party chairman Nadhim Zahawi.

Zahawi claims he was forced to pay the UK tax authorities an estimated £5 million punitive settlement owing to an “error” on his part, having failed to declare profits he gained through an offshore Gibraltar company, Balshore Investments, from the sale of the polling company You Gov, which netted Balshore circa £27m.

The problem is that for years, including when he was chancellor, Zahawi has publicly denied any beneficial ownership of Balshore, claiming it was owned by family members and that he personally derived no benefit. This despite evidence which shows that dividends payable to Balshore were diverted to write off loans made by You Gov to Zahawi (a founder and director).

Worse, the settlement was negotiated and arrived at whilst Zahawi was in charge of the tax department as chancellor and whilst he was still denying he’d benefited from the offshore company.

“He came to this country, as you know, with nothing”

Cleverly started by trying to praise Zahawi’s ‘transparency’ over this matter which was settled in the middle of last year, despite it being pointed out that the statement admitting the ‘error’ only came out after the matter was exposed by a newspaper last week.

When questioned why the chairman of the Conservative party had lied about this (and indeed why he has not resigned from this latest key post) Cleverly repeatedly deflected into promoting Zahawi’s “backstory”, praising how he had arrived in Britain, aged 11, as an Iraqi Kurdish refugee “with nothing” and had achieved immense success as a business entrepreneur providing taxpaying jobs.

The point I have made is this tax was due because he was a successful entrepreneur who grew a business from nothing ah.. you know he came to this country with nothing, as you know, his back story escaping violent persecution and possible death in Iraq, coming to this country with nothing, um unable to speak English and he built a very very successful company er employing people and that is why these taxes were due. And ultimately he in conversation with HMRC came to the arrangement whereby those taxes were fully paid. [Cleverly told Sky interviewer Sophie Ridge]

A closer look at Mr Zahawi’s past and present, however, points not to a history of poverty and enterprising success but more to a background of considerable wealth tied in with Iraqi political connections that provided enormous business advantages for his family both prior to the regime of Sadam Hussein (whom the family fled) and then subsequently when western money was re-building the post-war infrastructure in the state.

Not long prior to the family’s flight Nadhim’s grandfather had acted as the Governor of the Central Bank of Iraq and then Minister of Trade. Zahawi’s father Hareth is an Iraqi based businessman and it is clear that he is a very substantial one.

The family had fled in 1977 because Hareth had been warned the then Deputy President, Sadam Hussein, had included his name in the list of those being rounded up by his military thugs during his bid for power. He immediately jetted out to Britain and arranged for his family to follow him, not as refugees but as migrants.

Nadhim was soon enough enrolled in Kings College School in Wimbledon which is an expensive fee-paying school. Later, according to this backstory, the family suffered a devastating failed business venture. However, Zahawi’s mother was able to pawn jewellery to make sure her son would have no financial difficulties studying chemical engineering at London University.

Many would regard this as a privileged start, thanks to the family’s foreign wealth.

After university Zahawi gravitated to conservative politics and fell into the now disgraced Jeffry Archer’s circle thanks to the conservative peer’s campaign to highlight the well-known plight of the less fortunate Kurds who’d remained under oppression in Iraq.

He assisted Archer’s controversial fundraising concert from which only a fraction of the money raised was allegedly traced to Kurdish charities.

It was while working on Archer’s subsequent ill-fated campaign to become London Mayor that Zahawi met his future business collaborators. However, Archer himself was exposed for having consistently lied and perjured himself in a libel suit and was forced to abandon his campaign ending up in jail.

One would have thought this ought to have been an important lesson for the young Zahawi on the importance of candour in public life.

Meanwhile, together with Archer’s key aide, Stephan Shakespeare, and helped by a substantial loan from a business investor he set up the company You Gov which forms the foundation of his reputation as a successful entrepreneur – it was sold in 2017 as a major success story, presenting an estimated £27 million profit to Balshore Investments which Zahawi claimed belonged to other family members not him.

Indeed, after media had begun questioning his Gibraltar connections back in 2013 (he used another Gibraltar company, Berkford, to buy a million pound estate in his Warwickshire constituency) new disclosures were added to Balshore’s previously opaque records, naming his father and a Dubai based business as directors.

Such belated frontwork clearly failed to convince the Inland Revenue that Balshore was anything more an off-shore instrument controlled by then Chancellor to evade taxes, given the punitive settlement that prevailed.

Yet Zahawi’s story of conspicuous wealth plainly extends far beyond his You Gov windfall and goes back before 2017 – right back to his influential family’s roots in Kurdistan (he is the second richest MP in Paliament after Rushi Sunak).

Surely, the extent to which this ‘self-made British entrepreneur’ is tied to foreign wealth and political influence deserves the fullest possible disclosure, given his current chairmanship of the UK’s governing party?

Foreign Money

Whilst Nadhim has remained in the UK his father Hareth is recorded as having returned to ply business in the opportunity fuelled environment of post-war Iraq following the toppling of Sadam Hussein by British and US forces.

By 2003 the businessman was cited as a ‘prominent Iraqi’ in the Los Angeles Times who was doing deals with the controversial company Halliburton as part of the reconstruction:

“Iraqi companies need to come first,” said Hareth Zahawi, an Iraqi-British businessman whose Al-Zahawi Group landed a subcontract from Halliburton Co. to provide labor and procurement services for allied authorities in Baghdad. He’s hiring only Iraqis, and so far has put about 400 on his payroll.

Zahawi is helping organize a coalition of business and industry associations to lobby for reconstruction work, pressure contractors to hire Iraqis, and promote a proposal to require 51% Iraqi participation in new business ventures.

The business sounds profitable with the well-established local political family working on their extended international links to funnel money.

Perhaps it is not surprising therefore that the UK based and politically connected Nadhim subsequently landed a role as the ‘strategic advisor’ to Gulf Keystone Petroleum, a company that was struggling to dominate in the fiercely contested oil concessions in the Zahawi family’s native Kurdish region of Iraq.

Interestingly, it is reported that that highly lucrative consultancy came as a consequence of a visit by Zahawi to the region in 2015 in his capacity as co-chairman of the All Party Parliamentary Group on Kurdistan – his remuneration for the role (Gulf Keystone was to successfully win a crucial court case defending its concessions in London) was to total a staggering £1.3 million before he resigned on becoming a minister – based on a fee of £1,000 an hour.

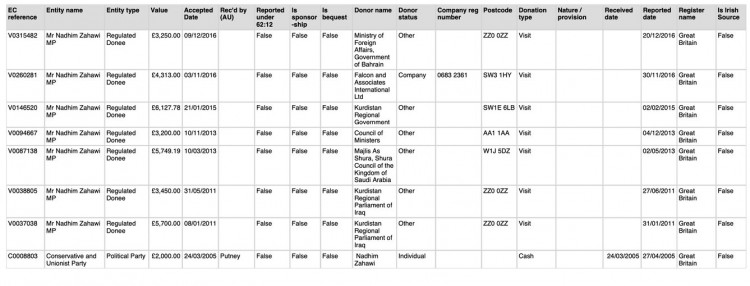

Zahawi continues to nurture his ties with the region, visiting the area frequently both in an official and personal capacity, according to Kurdish sources. Indeed, his register of interests reveals him to have received a number of payments from the Kurdish Regional Government and Parliament apparently relating to the costs of visits to the region.

Zahawi & Zahawi Ltd

Indeed, there are indications that the majority of the Zahawi business fortune was made after he became an MP and not before whilst a mere businessman, as has been heavily implied.

One month after becoming an MP in 2010 Zahawi set up a company together with his wife, Zahawi & Zahawi Ltd, described as a business advisory service, which subsequently made considerable property investments. These raise questions over the extent to which his full earnings have been declared and to which he still controlled the business whilst a minister of state.

Originally, he co-owned and co-directed the company as an MP, together with his wife, Lana Fawzi Jamil Saib. Over the subsequent eight years, during which it was declaring circa £2,000 a month in consultancy fees, it purchased considerable property investments now calculated in the media to be worth some £200 million.

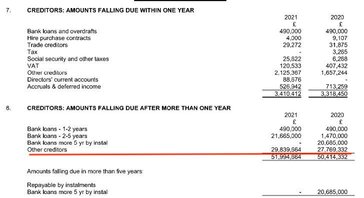

Company and property research reveals that whilst several of these properties (acquired in the course of 2016) attracted mortgages (from Santander) the majority of the investment has been categorised in the form of unsecured loans from ‘other creditors’, cited as including his wife.

Given his previous errors and in the interests of transparency might the Conservative chairman, who has so far said he refuses to resign, now declare the origin of these loans in order that any concern they might in fact be a way of investing foreign earnings in this country while avoiding tax?

The day after Mr Zahawi was promoted to ministerial status, January 2018, he stepped down as the director of this company and handed all his shares and control to his wife. She subsequently altered her name in the company records to her maiden name. Was this sufficiently distancing himself from his business activities one might ask, in line with the ministerial code?

There are other issues that require an answer which the current press furore has yet to raise. Does Mr Zahawi also possess off-shore investments to match match his relationships with a bank in Jersey and an asset manager in Luxembourg? If so, they are not mentioned in his register of interests.

Specifically, another Zahawi property development company set up in 2018, Zahawi Brierley Hill Ltd, received a loan not from a bank but from Aviva Investors Multi Asset Alternative Income S.A., which is a Luxembourg-based asset manager.

Likewise, for the purchase of their £13 million town house in Wilton Crescent (which is in the name of Zahawi and his wife) a loan was arranged with the Jersey based branch of Standard Chartered Bank.

Why the two off-shore instruments which might be seen to indicate assets in these locations?

Crowd2Fund Ltd

The tendency for the former chancellor and present party chairman to appear to be hiding behind others in terms of beneficial ownership has similarly raised its head over another reported investment by Balshore Investments – the same Gibraltar company with shares in You Gov – this time in a crowdfunding enterprise started by the brother of Zahawi’s close political colleague, Matt Hancock, Crowd2Fund.

Balshore initially owned 50% of the company and was declared a ‘Person with Significant Control’ in April 2016, but four years later in an unusual move, the company record retrospectively annulled that statement although Balshore remains the biggest shareholder with 25%. The declaration was four years late, as it should have been filed within 14 days.

The next unusual move came when on 10th June 2022 Crowd2Fund registered Mr Zahawi’s parents as beneficial owners of the firm. They had not been mentioned just a month beforehand in the annual accounts and it might appear the intent was to strengthen the narrative that it was the Zahawi parents not Nadhim behind the investment.

This leaves a series of gaps and discrepancies amidst a pattern of Macavity-like behaviour by the wealthy politician who appeared to be connected to these business deals and has displayed enormous wealth, but denied his own involvement.

As forensic interest and expertise is now directed burningly into his affairs, Zahawi, like his early mentor Lord Archer is likely to discover how the truth will out. He has refused to resign and, to delay the issue, the PM who appointed him has announced he will refer matters to the newly restored ethics advisor (Boris Johnson scrapped the post during his own spate of scandals).

There are immigrants and there are immigrants

What the unfolding revelations do spell out is the hollowness of attempts by the likes of James Cleverly to cast his fellow grandee in the role of a ‘plucky immigrant made good’, just as his party ramps up its campaign against poorer migrants.

Mr Zahawi’s family fortunes are clearly more in line with the foreign wealth more readily welcomed by the Conservatives and glaringly evident in the party’s supposedly ‘diverse’ leadership line-up: the majority of the first and second generation British who have been elevated by the party are extremely rich and several, like Zahawi, owe their wealth to continuing family ties with their country of origin where they remain highly well-connected.

This of course tallies with the perception that wealthy new arrivals should be greeted as welcome big spenders, compared to poor arrivals who are treated merely a burden.

In fact, as economists and observation make clear, Britain’s poorer arrivals have played a vital roles in helping keep business buoyant and the standard of living high. They get to work, pay tax, generally seek to integrate and have kept farms, shops and transport working affordably for the rest of the ageing and professional population.

By contrast, the super-rich with convenient global ties are fairly notorious for exploiting the international loopholes in order not to pay tax on their vast fortunes, thereby keeping more than they contribute.

It was therefore crass of Cleverly to try to paint Zahawi as just the sort of migrant his party normally seeks to kick out before they get a chance to ‘make good’.